It’s official – Disney+ has surpassed Netflix in subscribers. Now, take this with a grain of salt – as Disney+ includes ESPN+ and Hulu, two other streaming services the entertainment company owns. Nevertheless, the milestone is an important one – as Disney is poised to take a stronger grip on the streaming space than ever before. This has investors – such as hedge fund manager Dan Loeb – incredibly bullish on the stock. Should you be as well? We’ll discuss some key insights into what has earned Disney stock a buy rating at this time.

It hasn’t been a great year for Disney through the first two quarters. The stock has been in a perpetual downfall – reaching a low point of $90/share back in mid-July. But, it appears that momentum is forming for a trend back in the right direction. The company stock has risen 30% since July – and isn’t showing signs of slowing down. This is thanks in part to the huge subscriber jump that led to surpassing Netflix. This was coupled with an impressive earnings report. Revenue came in at a half billion dollars over the estimates from Wall Street. This overperformance wasn’t just from an increase in subscribers – although that did play a role. The company also brought in an additional billion dollars from their parks, experience, and consumer products channels.

Just the news that Dan Loeb has purchased a significant stake in Disney caused shares to rise 2%. The hedge fund manager has also outlined what he believes to be the key next steps for unlocking future growth in the short term. Let’s dig into the actual analysis of the stock in the present day to determine why it’s been rated a buy in the VectorVest system.

The Two Main Reasons Disney is Rated a Buy in the VectorVest System

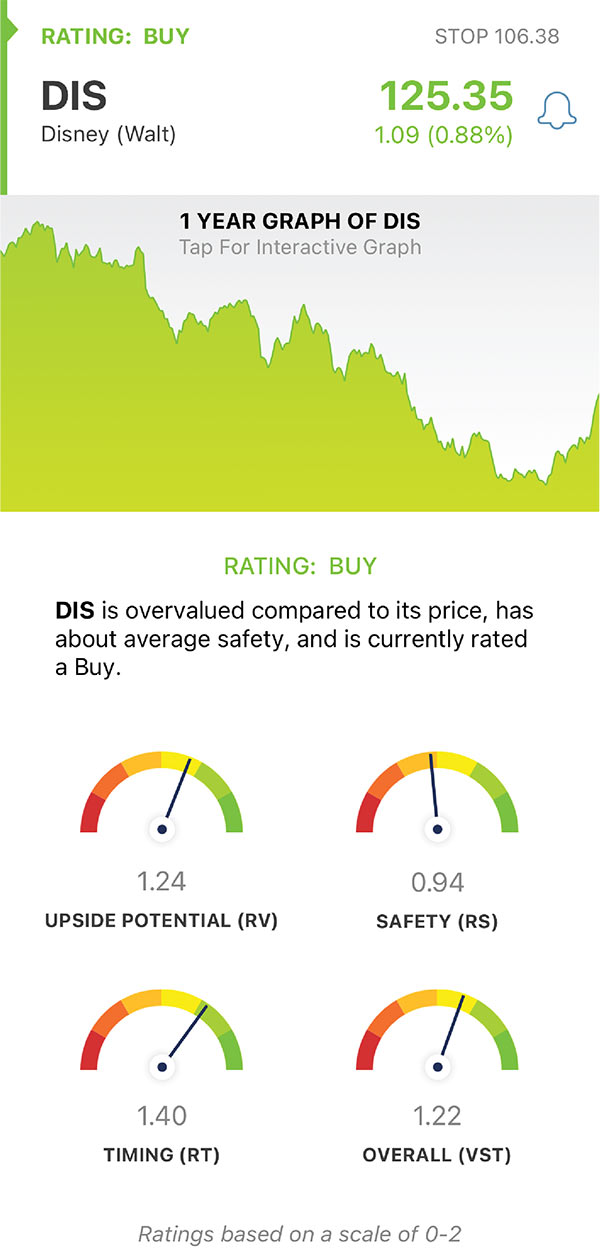

The VectorVest system has transformed traditional stock analysis to make investing simple. Our proprietary rating system has boiled all critical fundamental and technical analysis down to three easy-to-understand metrics: relative value (RV), relative safety (RS), and relative timing (RT). By relying on these three ratings and their average – the VST rating – you can eliminate guesswork and emotion from your trading decisions.

Disney’s RV is 1.24 – which is good on a scale of 0.00-2.00. We calculate this rating based on a deep analysis of the projected price appreciation three years out – so you get a better understanding of the upside potential for a stock. The RS is just 0.94 – which is right below average, suggesting that the consistency of & predictability of Disney’s financial performance leaves a bit to be desired. However, the two key indicators we want to take note of are the RT (relative timing) and forecasting earnings growth rate.

Disney has an RT of 1.40 – which is excellent. This suggests that a strong upward trend has already formed and is gaining momentum. The higher the RT, the stronger the trend. This, coupled with an impressive forecasted earnings growth rate of 30%, has earned Disney a VST of 1.22 – and a buy rating.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for DIS, it has good upside potential with excellent forecasted earnings growth. And, the timing is excellent at the moment. Despite a poor comfort index and slightly below-average safety, this stock has been rated a buy.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment