Nvidia chose to release 2nd quarter earnings a few weeks early – and the results were less than investors had hoped for. While the company is known for being reliable and safe, it fell short of expectations – coming in at just $6.7 billion in revenue. This is a 17% discrepancy from the $8.1 billion management was anticipating for the quarter. While competitor AMD has been thriving, Nvidia showed losses in 3 of its 5 sectors: gaming, OEM, and professional visualization.

And while tech companies like Nvidia failed to keep up with supply throughout the pandemic, this time, the cause for underperformance is actually a drop in demand. Further exacerbating problems for Nvidia was their decision to cut prices attempting to stimulate demand. This led to over a 20% drop in gross margin for the tech firm.

The news of a down 2nd quarter resulted in Nvidia stock dropping 8% – but soon after, the stock rallied back erasing the losses. This has investors perplexed – why is the stock performing well despite a bad earnings release? Why is the stock trading higher now than prior to this news?

The fact of the matter is that Nvidia is still primed to finish the year strong and head into 2023 on track for continued growth. The main cause for the down quarter was a drop in supply for their gaming graphics card segment – and this specific industry is expected to grow up to 14% through 2026. Furthermore, Nvidia could start staking its claim in huge markets – like data centers, automotive, and even AI. And by simply looking at the company with emotionless financial analysis, there are three key reasons VectorVeststill has it rated a buy.

Three Reasons NVDA is Still Rated a Buy Despite 2nd Quarter Woes

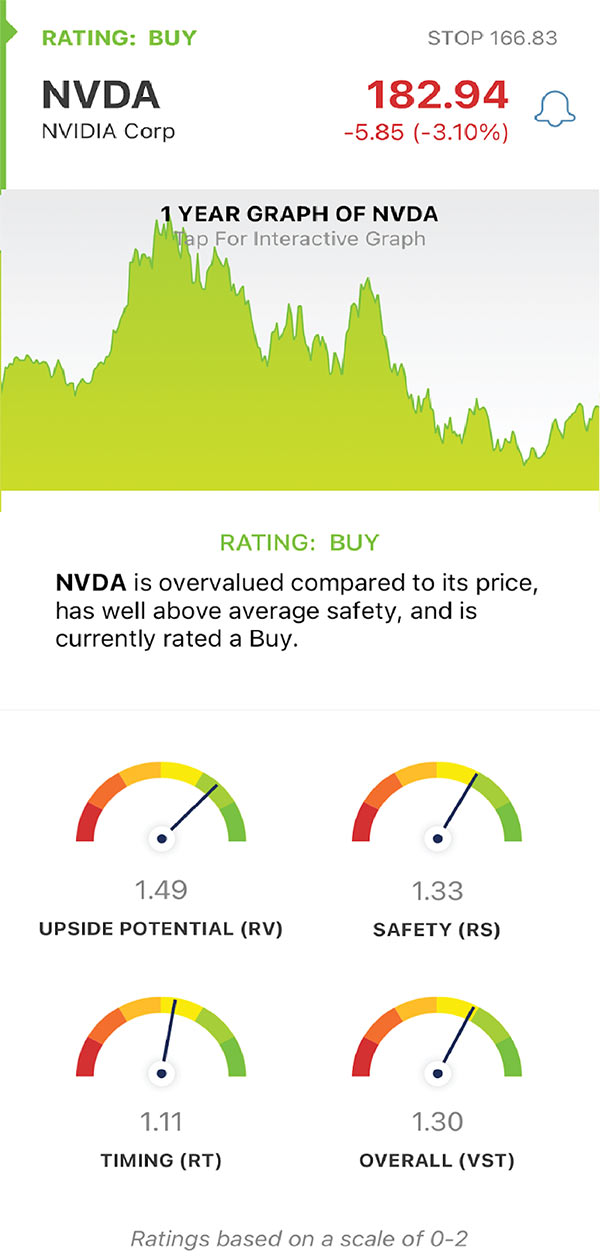

The VectorVest system simplifies investing by boiling down all technical analysis and indicators into three simple metrics: relative value (RV), relative safety (RS), and relative timing (RT). These ratings are placed on a scale of 0.00-2.00 – the closer to 2, the better. Together, these ratings make up the overall VST rating a stock is given – which dictates whether the stock is rated a buy, sell, or hold. And as of now, NVDA is rated a buy with a very good VST of 1.30. Here are three key reasons:

- Excellent upside potential: with an RV of 1.49, the long-term appreciation potential for Nvidia is excellent. This rating is derived from a deep analysis of projected price appreciation three years out.

- Excellent forecasted earnings growth rate: earnings drive the market and are one of the key areas we look at during analysis. And by looking ahead at the 1-3 year forecasted earnings growth rate for NVDA, we see a 33% increase – which is excellent.

- Very good safety: as mentioned earlier, RS is an indicator of risk. And as of now, NVDA is showing a very good safety rating of 1.33. This comes from an analysis of the consistency and predictability of a company’s financial performance, business longevity, price volatility, and more.

On top of these three key indicators, the timing for Nvidia is also good at 1.11. This suggests a slight trend in the right direction. However, investors should keep up on this RT rating – if it drops below 1.00, that will signal a change in the direction of the trend . However, all this considered, NVDA has been rated a buy in the VectorVest system.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock picking software and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Nvidia, it has excellent upside potential and forecasted earnings growth, it’s very safe, and the timing is pretty good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment