by Leslie N. Masonson, MBA

Investors always find it a challenge on where to invest their money. For example, depending upon the market cycle, large caps may be leaders while mid-caps and small-caps may be laggards. At other times, U.S. stocks can greatly outpace international stocks, as they have for many years and vice versa. In 2023 the “Magnificent 7” had a tremendous run and positively impacted the performance of the S&P 500 index which increased by 24.2%. Without these seven stocks, the S&P 500 would be up only a few percentage points.

In 2023, in particular small cap ETFs with a return of 17.6% did not perform well compared to large caps and mid-caps (16.6%). Therefore, investors using a contrary investing approach may find that the small cap arena is the place to be in 2024, as the past year’s underperformer. And in particular small cap value has not had a very good performance in 2023 gaining only 9.1%, although they held up well on a comparative basis in 2022 when the stock market had a very bad year.

According to ETFAction.com, there are 190 small-cap ETFs, but when broken down by value and growth classification, the numbers are much lower. For example, there are 26 small-cap value ETFs valued at $77.06 billion, while there are 21 small-cap growth funds with an AUM of $43.7 billion. Moreover, small-cap value and growth ETFs are two categories that are often-times ignored by investors in favor of the more popular index ETFs or large-cap varieties where the large tech stocks hangout.

Basics of Small Cap Value ETFs

The remainder of the article will focus on small-cap value ETFs, and will provide useful information to investors interested in that category. This ETF style may be the big winner in 2024, especially if the stock market has a more difficult time than 2023.

Small-cap value ETFs hold small-cap stocks that are considered undervalued as they typically below their intrinsic value .These stocks usually have both low price-to-earnings and price-to-book ratios.

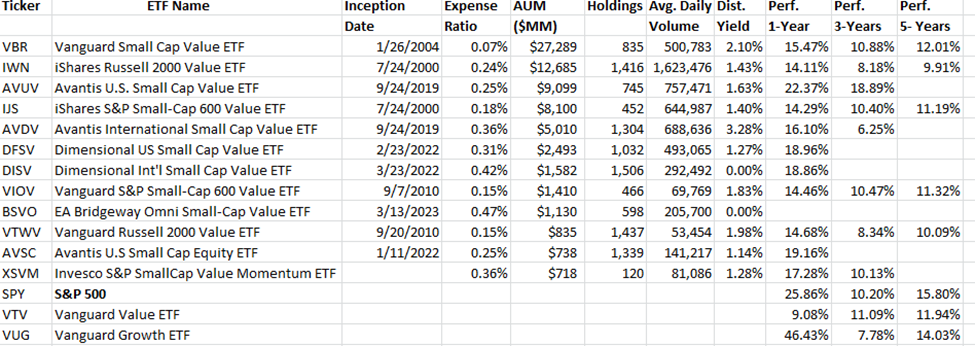

The top five ETFs in this category based upon Assets under Management (AUM) are shown in the table below from ETFAction.com and are as follows:

- Vanguard Small-Cap Value ETF (VBR)

- iShares Russell 2000 Value ETF (IWN)

- Avantis U.S.Small-Cap Value ETF (AVUV)

- iShares S&P Small-Cap 600 Value ETF (IJS)

- Avantis International U.S.Small-Cap Value ETF (AVDV)

The table below contains the top dozen small-cap value ETFs with some important metrics. Note that the two behemoths are VBR and IWN which have been around for 19, and 23 years, respectively. VBR has the lowest annual expense ratio of the group at 0.07%, and has performed well in all the time frames shown, and better than that of its competitor IWN. Note that the S&P 500 Index at the bottom of the table has performed better than VBK in all time periods.

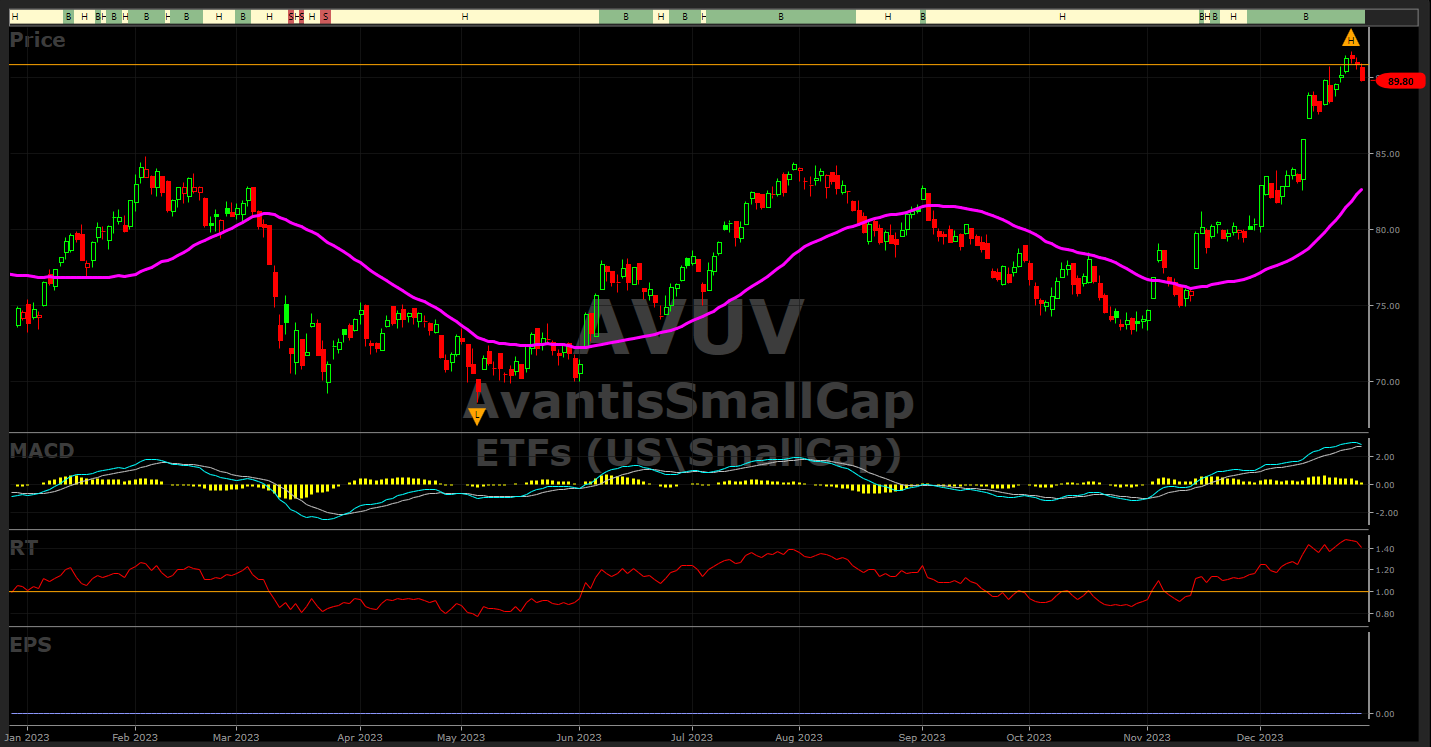

One ETF in particular shows outstanding one- and five-year returns is Avantis U.S. Small Cap ETF (AVUV). Refer to the chart below for its one-year performance view. It had slightly lower returns than the S&P 500, but a higher return that the generic value ETFs VTV and even VUG, the Vanguard Growth ETF that had a phenomenal 2023. This latter ETF got creamed in 2022; therefore its three-year return of only 7.78% is understandable, while AVUV was up almost 19% in three years.

Small cap value ETF performance at times, as is quite cyclical; however, these ETF usually perform well during economic recoveries, as well as periods when value stocks show relative strength vs. small cap growth, as has been the case from January 2005 to mid- 2008, and more recently from January 2022 to April 2023, as well as from November 20, 2023 to December 30, 2023. Using relative strength analysis or comparing the ticker for Vanguard Value ETF (VTV) to Vanguard Growth ETF (VUG) can show a change in leadership, thus pinpointing when it is time to get aboard.

In summary, small-cap value ETFs are best suited for conservative investors that are searching for a middle ground between growth and lower volatility, preferring a long-term holding period, and benefiting from the potential for undervalued stocks to outperform over time, especially in difficult stock market environments. Remember, that individual suitability depends on one’s specific investing goals, risk tolerance, and timeframe.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment