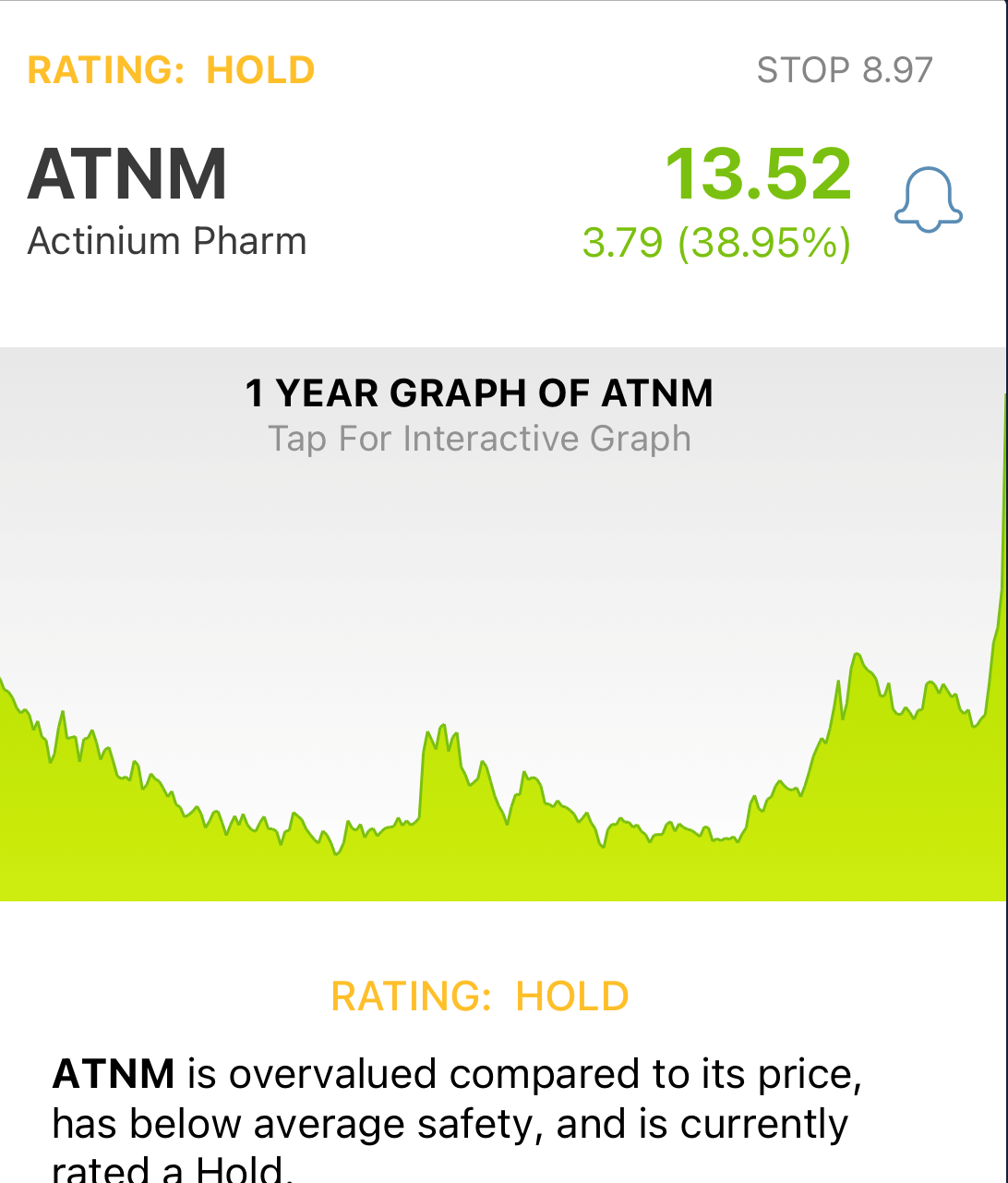

Actinium Pharmaceuticals (ATNM) is one of the biggest movers early Monday morning. The stock is up 39% for the day after the firm released news that their latest trial results were more than optimistic.

The company specializes in developing targeted therapies for cancer. Their therapies are known as antibody radiation conjugates – a special treatment that leverages the targeting capabilities of antibodies with the cell-killing capabilities of radiation. And the therapy that’s creating a stir right now is known as Iomab-B.

Iomab-B is Actinium’s leading product right now and seeks to treat refractory acute myeloid leukemia (AML). The phase 3 trial in question was conducted on patients 55 years or older. And as the stock ticker suggests, the results were very positive. Actinium reports that the treatment resulted in statistically significant differences compared to the control group. More specifically, the patients that were treated with Iomab-B (along with a bone marrow transplant) saw a better rate of complete remission.

This is just the early results of the study. Coming later this year will be the full report, which also analyzes overall patient survival as a secondary endpoint. And in the first half of next year, Actinium will file for FDA approval. This is where investors really stand to benefit – as everything is speculation until the treatment is actually sent to market.

In the meantime, though, investors and analysts alike are taking interest in ATNM stock. One analyst – HC Wainwright – has moved his price target from $45/share to $53/share after this news – while doubling down on the buy rating he’s given.

And in looking at the trajectory of ATNM, the stock doesn’t appear to be slowing down anytime soon. It’s up over 62% in the last year.

So, should you hop aboard the trend and capitalize on this speculation with the rest of the market? Or, should you await FDA approval before making a position in this stock? If you’re currently invested, you may be wondering if now is a good time to sell your position and capture profits. Whatever your situation, VectorVest’s stock analysis tools can provide you with a clear buy, sell, or hold recommendation for ATNM stock right now. Here’s what you need to know…

Does Excellent Timing Justify Investing in a Stock With Poor Upside Potential?

The VectorVest system changes the way you trade forever. No longer do you need to analyze countless charts and indicators, clouding your decision-making and adding unnecessary complexity to your strategy. With VectorVest, you can rely on just three ratings to tell you everything you need to know about an opportunity: relative value (RV), relative safety (RS), and relative timing (RT).

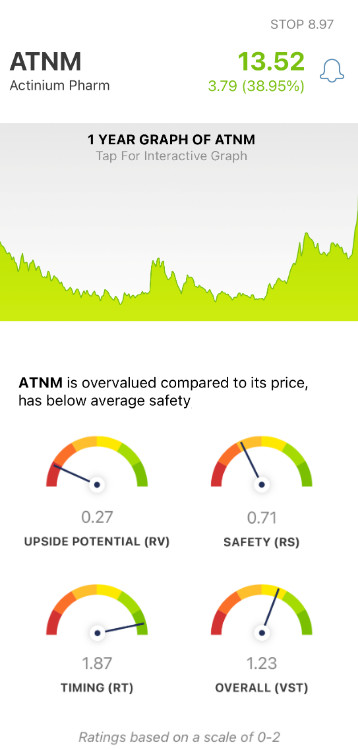

These sit on an easy-to-understand scale of 0.00-2.00, making interpretation as effortless as possible. Just pick stocks with the highest VST ratings and win more trades. To make things even easier, the system provides you with a clear buy, sell, or hold recommendation for any given stock at any given time based on these ratings. As for ATNM, here’s the current situation:

- Very Poor Upside Potential: The RV rating takes a look at a stock’s long-term price appreciation potential up to three years out. The current RV rating of ATNM is very poor at just 0.27. Moreover, VectorVest calculates the current value to be just $2.72, suggesting the current price of $13.54 is overvalued.

- Poor Safety: An indicator of risk, the RS rating analyzes a stock’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for ATNM, the RS rating of 0.71 is poor.

- Excellent Timing: As you could see by looking at the stock chart for ATNM, it has a strong positive price trend. The excellent RT rating of 1.87 reflects that – as this rating analyzes the direction, dynamics, and magnitude of a stock’s price movement. It looks at the trend day over day, week over week, quarter over quarter, and year over year.

All of this considered, the overall VST rating of 1.23 is good – but is it enough to earn ATNM a buy? Or, should you keep holding for further information on their lead therapy? The VectorVest system can give you a clear answer on what your next move should be – just get a free stock analysis and find out.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for ATNM, it is overvalued with very poor upside potential and poor safety – but it has excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment