As of 11 AM EST Friday morning, Nuvalent has gained over 50% on its share price. The stock topped out at around $38/share (a 75% gain) but has started to trend back downwards and currently sits at $33/share. What happened to cause this spike?

The company creates precisely targeted cancer treatments designed to overcome the limitations of existing therapies. And this morning, executives released data from their latest clinical trial – evaluating the efficacy of NVL-520. While this is early in the initial testing, the results are promising.

This specific treatment is designed to address a common problem with most cancer treatments: kinase resistance and selectivity. It has been specifically engineered to penetrate the brain and help patients with brain metastases. And so far, there have been no dose-limiting toxicities, treatment-related serious adverse events, dizziness, or other side effects/setbacks that would lead to delays in further testing or getting this drug to market.

Now, we’ll have to continue waiting to see what the remainder of phase 1 holds for Nuvalent and NVL-250. But looking at the stock purely from an investment standpoint, things are trending in the right direction. It’s also worth noting that BMO Capital – an investment banking company – raised its price target on the firm from $28/share to $50/share.

And, this isn’t the only company that’s taken a stake in Nuvalent. Other institutional investors and hedge funds see the value in this company as well – including STRS Ohio, a retirement pension fund.

Everyone else appears to be high on Nuvalent, even though concrete results from NBL-250 are likely a while from being released. This begs the question – what should you do with Nuvalent as an investor yourself? Is this a good time to buy – or have you missed the window of opportunity after today’s big bump?

To get a clear answer on what your next move should be with Nuvalent, you can take a look through VectorVest’s stock analysis software. This will give you a clear buy, sell, or hold recommendation – so let’s take a look.

Very Poor Upside Potential vs Excellent Timing: Does One Outweigh the Other?

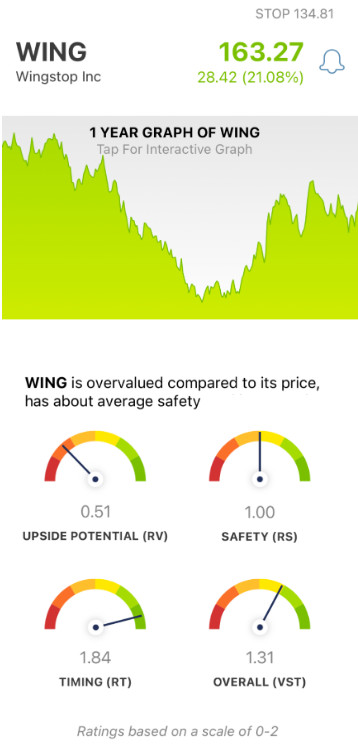

The VectorVest system changes the way you approach trading forever. It summarizes everything you need to know about a stock into three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). The interpretation of these ratings is as straightforward as it gets – they sit on a scale of 0.00-2.00, with 1.00 being the average. Anything over 1.00 is outperforming the average, and vice versa.

The best part? Based on these three ratings, the VectorVest system is able to provide you with an overall VST rating for any given stock, at any given time – along with a clear buy, sell, or hold recommendation. Here’s the current situation with NUVL:

- Very Poor Upside Potential: The RV rating takes a look at long-term price appreciation potential, projected up to three years out. And right now, the RV rating of 0.13 is very poor on a scale of 0.00-2.00. Furthermore, NUVL is overvalued at the current price of $33.28 – VectorVest calculates the current value to be just $4.53.

- Poor Safety: The RS rating analyzes a company’s financial predictability and consistency, debt-to-equity ratio, and business longevity – assessing the overall risk of a stock. As for NUVL, the RS rating of 0.58 is poor.

- Excellent Timing: Despite the previous two ratings, NUVL has an excellent RT rating of 2.00 – topping out the scale. This rating is calculated based on the direction, dynamics, and magnitude of a company’s price trend. It looks at the trend day over day, week over week, quarter over quarter, and year over year.

All of this considered, the overall VST rating for NUVL is 1.28 – which is very good.

But does that mean the stock is a buy, or should you keep holding out to await further confirmation in the testing of NVL-250? Does the very poor upside potential & poor safety ratings of this stock outweigh excellent timing – or vice versa?

To get a clear answer on what your next move with NUVL should be, analyze the stock free here..

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NUVL, it is overvalued with very poor upside potential and poor safety, but it has excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment