Albertsons (ACI) stock has risen over 10% so far Thursday morning due to rumors that the grocery store chain could merge with one of their much bigger competitors: Kroger. And we won’t have to wait long to see how this pans out. Sources say a deal could be reached as early as tomorrow before the market closes.

It’s been rumored that the deal will be all cash, but there is currently no dollar amount to accompany these rumors. What we do know is that together, these two companies would have a market cap of roughly $47 billion ($32.9 billion for Kroger and $14.9 billion for Albertsons).

Those unfamiliar with Albertsons may not realize just how dominant they are in the grocery space. They own Safeway, Acme, Tom Thumb, and 17 other retail brands. They have 2,200 supermarkets across 34 states. And unlike most publicly traded companies, they’re actually trading up over the past year. They’ve been mostly unaffected by the rising rate of inflation and a dwindling pandemic.

And while investors are certainly excited about this deal – especially if they already bought into Albertsons at a better value than it sits today – there is reason to believe it won’t be easy to get it done.

Experts predict this deal could face scrutiny from US officials like the FTC. That’s because the merger of these two companies could create a grocery market giant that treads a bit too close to antitrust territory. This comes at a time when food price inflation is soaring higher than it has in the past 40 years.

Nevertheless, you’re wondering if the time to buy ACI stock is now – ahead of the pen hitting paper and these two firms finalizing a deal. While the stock is already up today from the rumors alone it could soar much higher when a deal becomes official. Or – is there still too much up in the air? Should you wait for confirmation? After all, neither Albertsons nor Kroger have commented on these rumors.

The truth of the matter is we don’t know what will happen with this deal. What we do know is that VectorVest can help you find a clear answer to what you should do next from an investment standpoint. Let’s take a look at what the stock forecasting tool has to offer for Albertsons stock right now.

2 Optimistic Signs for Albertsons Investors to Take Note of

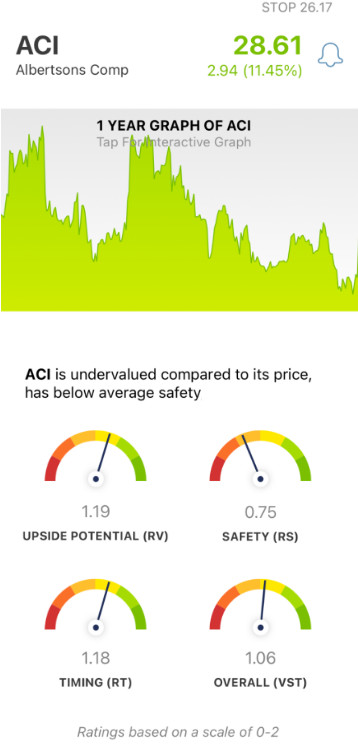

The VectorVest system simplifies trading by boiling down all that you need to know about a stock into three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). The best part is that these ratings sit on a scale of 0.00-2.00 with 1.00 being the average. The higher the rating is, the better a stock is performing in that category. Pick the stocks with the highest ratings and win more trades – it’s really that easy.

Better yet, the system compiles these three ratings into an overall VST rating – and even offers you a clear buy, sell, or hold recommendation for any given stock, at any given time. As for Albertsons, there are two particular ratings that have investors optimistic:

- Good Upside Potential: Albertson’s price right now is fluctuating around $28.79/share – which is undervalued, as VectorVest calculates the current value to be closer to $32.48/share. Moreover, the RV rating of 1.19 is good – suggesting that ACI has long-term price appreciation potential, calculated up to three years out.

- Poor Safety: An indicator of risk, relative safety takes into account a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for ACI, the RS rating of 0.75 is poor.

- Good Timing: RT evaluates the price trend of a stock – looking at the direction, dynamics, and magnitude of price movement. It’s calculated based on trends day-over-day, week-over-week, quarter-over-quarter, and year-over-year. And as you can imagine, the price trend for ACI is good right now – with an RT rating of 1.18.

The overall VST rating for ACI is fair at 1.06 – but does that mean you should buy now, or keep waiting to hear more about the deal in question? VectorVest can give you a clear answer on whether you should buy, sell, or hold ACI right now. Trust us – you’re not going to want to miss out on this one…get a free stock analysis here to discover your next move!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for ACI, it is undervalued with good upside potential and timing – but it has poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment