One of this morning’s biggest movers is Nutanix. The cloud platform provider & software engineer firm is up almost 25% as of 11:30 am EST. This is all a result of speculation that the company is on the market for takeover. While this is all just that – speculation – investors have responded by pumping the stock up to a high it hasn’t seen since April of this year.

We don’t know much about the potential for Nutanix to actually go through a sale and takeover – as the company refused to comment. What we do know is that experts predict any sort of acquisition would be done by private equity investors or industry players. And the asking price for Nutanix would be quite a pretty penny, as the company currently has a market cap of just under $5 billion.

Rumors or not, this is certainly good news for NTNX investors – who have had a tough year. In the past 365 days, the stock has fallen over 26%. The company reached a low point this summer in June when the stock bottomed out at around $13.75/share.

This trend mirrors many other B2B companies which thrived during the COVID-19 pandemic and fell flat as a return to normal. Nutanix, in particular, was hit by a sharp equities selloff and the economic reopening.

Before the acquisition rumors that sent it spiking today, though, Nutanix was already on the road to recovery. The company reported impressive earnings for the 2nd quarter of 2022. This was further solidified when they provided a positive outlook for the future, with upbeat projections. But it’s no secret that this rumor has helped their case – now looking at the stock through a 3-month chart you see an 80% gain.

At this point, there’s not much else we know about Nutanix’s future – we’ll have to wait and see what happens with this takeover. However, investors like you are wondering what they should do right now. Should you buy the hype this speculation has created – or is this a case of “if you’re reading this it’s too late”? Should you await further information before making a play?

You’ve got questions, we’ve got answers. We can take an unbiased, emotionless look at what your next move should be through the VectorVest stock analysis software.

Does Excellent Timing Outweigh Very Poor Upside Potential – or Vice Versa?

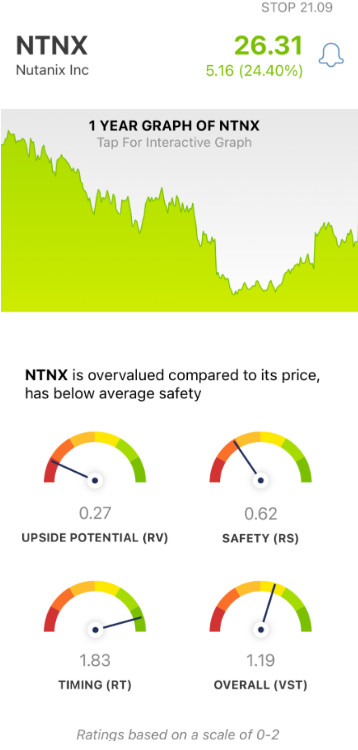

The VectorVest system simplifies analysis and transforms the way you uncover and validate opportunities in the stock market. It does this by simplifying all that you need to know about a stock into three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 – with 1.00 being the average. Anything lower than the average indicates underperformance and vice versa. Together, these ratings make up the overall VST rating a stock is given.

But here’s the kicker: based on these ratings, the system can actually provide you with a clear buy, sell, or hold recommendation for any given stock, at any given time.

Let’s take a look at what the system currently has to say about NTNX:

- It’s Overvalued with Very Poor Upside Potential: In looking at the current price of $26.31/share for NTNX, VectorVest deems it overvalued – with a current value closer to $1.74. Meanwhile, the long-term price appreciation potential for this stock is very poor – with an RV rating of just 0.27.

- Poor Safety: Making matters worse, NTNX has poor safety with an RS rating of 0.62. This is calculated from an in-depth analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: This is where things get interesting for speculative investors in particular. Because despite the other two ratings for NTNX, it does have an excellent RT rating of 1.83 – based on the direction, dynamics, and magnitude of the stock’s price movement. This reflects what we see when looking at the price trend in the past few months, but especially today. NTNX is moving in the right direction and this trend has the wind in its sails. The only question is – how long will it last?

All things considered, NTNX has a good VST rating of 1.19 – but does that necessarily make it a buy? Or, should you wait out the hype today has caused and see what’s waiting for you on the other side? If you want a clear answer on your next move, we’ll give it to you – just analyze the stock free here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NTNX, it is overvalued with very poor upside potential and poor safety. However, it does have excellent timing right now, with the momentum pushing the stock’s price in the right direction.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment