The airline industry as a whole has been struggling as of late, and American Airlines (AAL) is the latest company to fall victim to a lackluster forecast. Yesterday, the airline company released its first-quarter profit forecast that left analysts and the market as a whole underwhelmed.

The carrier reset expectations for profit, with most guidance falling somewhere in the mid-range of previous forecasts of $0.01-$0.05/share. Meanwhile, analysts were hoping the company would reach the high end of these forecasts – reaching as high as 6 cents per share – especially after rival company Jet Blue recently improved its guidance.

While American Airlines expects a rise of 25.5% in its key revenue metric, the company has been struggling with fuel prices – which are up dramatically from this time last year. Moreover, there are concerns surrounding demand due to rising borrowing costs, inflation, and job losses.

As a result of all this, AAL shares fell 9.2% yesterday in Wednesday’s trading session. In the last year, shares are down almost 28%.

It’s worth noting that American Airlines isn’t alone in its plight. Rivals like United Airlines are also struggling with high labor and fuel costs despite an uptick in travel. That being said, investors of American Airlines won’t find much solace in this. If you currently hold shares in this company, you may be wondering if this forecast is your sign to get out.

You don’t have to play the guessing game or let emotion influence your decision-making – get a clear buy, sell, or hold recommendation by reading below. We’ve taken a look at AAL through the VectorVest stock analyzer software and have uncovered 3 things you need to consider.

Despite Excellent Upside Potential and Fair Safety, AAL Has Poor Timing

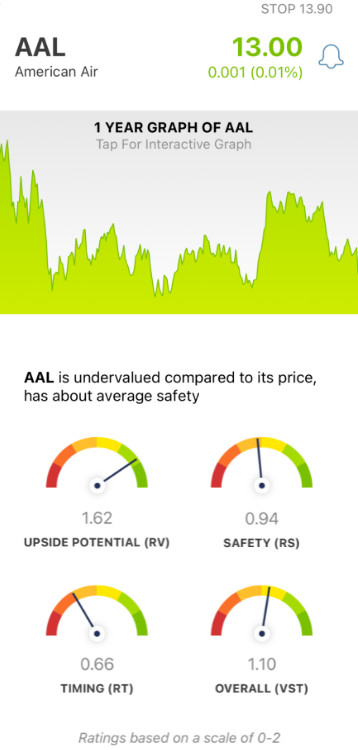

The VectorVest system helps investors simplify their approach to stock analysis by giving you all the insights you need in just 3 easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on a scale of 0.00-2.00, with 1.00 being the average. By picking stocks with higher ratings, you set yourself up to win more trades. Or, to make your strategy even simpler, you can just follow the buy, sell, or hold recommendation that VectorVest issues for a stock based on these ratings. As for AAL, here’s what you need to know:

- Excellent Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (3 years out) to AAA corporate bond rates and risk. And right now, the RV rating of 1.62 is excellent. Moreover, the stock is undervalued at today’s price - with a current value as high as $25.94/share.

- Fair Safety: In terms of risk, AAL is a fairly safe stock - as indicated by the RS rating of 0.94. This is derived from analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The one major issue for AAL right now is the negative price trend that has formed. As a result, the stock has a poor RT rating of 0.66. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, and quarter over quarter.

The overall VST rating for AAL is good at 1.10 - so, does that mean now is actually a good time to buy more shares? Or, is the updated forecast the company issued yesterday a sign of what’s to come in the future? Get a clear answer on what you should do with AAL through a free stock analysis at VectorVest and execute your next move with confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for AAL, it has excellent upside potential and fair safety - but poor timing is a real cause for concern for AAL investors right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment