This morning, UnitedHealth Group (UNH) reported first-quarter earnings that came in over expectations. The company doubled down on this success, raising the full-year outlook for 2023. And yet, shares of the company are falling – down nearly 3% in Friday’s trading session so far.

This has investors and the market as a whole perplexed. Revenue was up nearly 15% to $91.93 billion, which was leaps and bounds above analyst expectations of $89.70 billion. The company grew its bottom line too, with net income increasing to $5.61 billion, up from $5.03 billion in the same quarter last year. Earnings per share topped the analyst consensus of $6.16 at $6.26.

CEO Andrew Witty points to the growth in users the company serves as a reason for this sustained growth over the past 3-4 consecutive quarters. The company managed to reach an additional 2 million people and offer high-quality affordable care.

Looking ahead to the remainder of the year, UnitedHealth is confident this growth will continue. And in looking back at how consistently this company has grown over the past few years, there is little doubt they’ll achieve the raised guidance issued along with this earnings report.

The company expects higher EPS of $25.00 – $25.50, up slightly from the previous full-year outlook of $24.40 to $24.90. And yet, if you look at the stock today, it’s slipped. Despite consistent growth quarter after quarter, the stock is actually down in the last year.

With that said, a rally in the right direction had been forming over the past month – as the stock gained 10%. This begs the question – why is the stock falling after such an impressive report? This is where having a solution like the VectorVest stock analyzing software can be so powerful. We’ll help you tune out the noise by uncovering the 3 things you need to know about UNH below.

Despite the Market Reaction to UNH Earnings, it Has Very Good Upside Potential & Safety Along with Good Timing

The VectorVest system helps you make more calculated, confident decisions in the stock market with less work. This is thanks to the proprietary stock rating system, which tells you what to buy, when to buy it, and when to sell it.

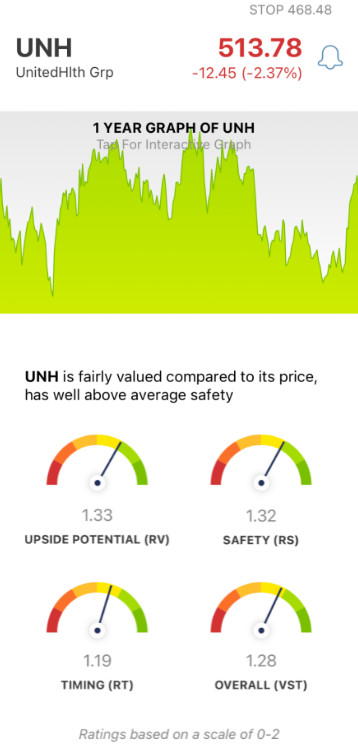

You’re given all the information you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a scale of 0.00-2.00, with 1.00 being the average. This allows for effortless interpretation.

But, making things even easier, VectorVest actually offers a clear buy, sell, or hold recommendation for any given stock at any given time based on these three ratings. As for UNH, here’s what you need to know right now:

- Very Good Upside Potential: The long-term price appreciation for UNH (3 years out) compared to AAA corporate bond rates and risk is very good - earning the stock an RV rating of 1.33. What’s more, the stock is currently undervalued. VectorVest deems the current value to be $543.92.

- Very Good Safety: The RS rating is an indicator of risk. It takes into account the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. And right now, the RS rating of 1.32 is very good as well.

- Good Timing: Despite this morning’s 3% slide in the wrong direction, UNH still has good timing with an RT rating of 1.19 - as a positive price trend has been forming over the last few months. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating for UNH is very good at 1.28. So with that said, should you ignore the market’s reaction to today’s news and just focus on the fundamentals behind this company - which are solid?

You don’t have to play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for UNH, it has very good upside potential and safety, with good timing to boot. Despite the market’s negative reaction to yet another quarter of excellent performance, the fundamentals behind this stock are solid.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment