Arm Holdings (ARM) is up more than 57% in Thursday morning’s trading session after delivering a strong earnings performance alongside an even stronger guidance for the current quarter.

The chip designer brought in $824 million in revenue for the quarter, easily surpassing the analyst expectation of $762 million. Profits were strong too with an adjusted EPS of 29 cents compared to the 25 cents analysts were expecting.

CEO Rene Haas says that the company’s record revenue performance can be attributed to the continued adoption of the world’s most pervasive computing platform.

Arm is poised to capitalize on the AI wave, as new devices rely on the company’s chip design. Some of its top customers include Nvidia, Dell Technologies, Hewlett Packard Enterprise (HPE), Lenovo, Quanta, etc.

Speaking of the AI wave, Arm expects to continue capitalizing into the current quarter. The company shared a strong outlook on revenue of $850 million to $900 million. Even at the low end, this is well above the FactSet consensus at $779 million.

Management sees the potential to continue taking a stranglehold on the cloud server market and auto segments. One of the most exciting wins for the company is the Nvidia GH200 AI Superchip data center systems on the horizon – which are to be powered by Arm chips.

Arm also noted in a letter to shareholders that more and more customers are transitioning to state-of-the-art Armv9 tech chip designs, for which the company will earn twice as many royalties.

The company has been public for less than 6 months but is already creating quite the stir. The stock IPOd at $51 and sits at more than double that price today at $121. Does today’s performance still leave room for investors to buy ARM, though?

We’ve taken a look at this opportunity through the VectorVest stocks software and found 3 reasons to buy ARM today. You’re going to want to see this…

ARM Has Fair Upside Potential and Safety With Excellent Timing

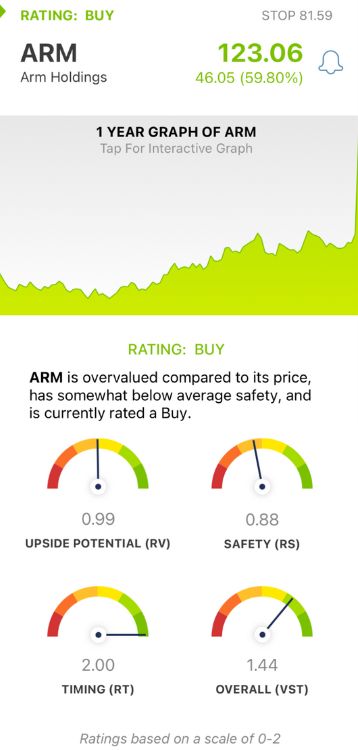

VectorVest simplifies your trading strategy by giving you clear, actionable insights in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even easier, though. The system also issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for ARM:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection) to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. ARM has a fair RV rating of .99 right now, right at the average.

- Fair Safety: ARM is a fairly safe stock as well with an RS rating of 0.88, albeit a ways below the average. This risk indicator is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors.

- Excellent Timing: This is where things really get interesting, as the RT rating of 2.00 is tipping out the scale for ARM. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.44 is excellent for ARM, and it’s enough to earn the stock a BUY recommendation. We encourage you to learn more before making your next move through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ARM is up more than 56% after a solid earnings performance coupled with an even stronger outlook for the current quarter. The stock has fair upside potential and safety with excellent timing, earning it a BUY recommendation.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment