It looks as if the positive price trend AT&T (T) has experienced over the last 3 months will continue. Early Wednesday morning, the telecommunications company reported fourth-quarter earnings that left analysts and investors excited, sending the stock over 6% higher by 10:30 AM EST.

Adjusted earnings came in at $0.61 cents/share, up 9% from the same period last year. This exceeded analyst estimates of $0.57/share. Total revenue from continuing operations rose just under a percentage point to $31.3 billion.

This alone wasn’t enough to act as a catalyst for today’s stock movement – it was also partially the result of impressive free cash flow figures. The company reported a full-year free cash flow of $14.1 billion compared to analyst expectations of $13.78 billion. In the 4th quarter alone AT&T reported $6.1 billion in free cash flow, which again, exceeded expectations by $730 million.

Taking things a step further, AT&T released a favorable outlook for the year ahead. In 2023, the company is projected to grow free cash flow with a total figure of $16 billion.

All of this has investors – and potential investors – wondering if it’s time to buy stock up on AT&T shares. The stock has climbed 11% in the last month alone – and today’s news will only help to solidify the price trend.

If you want a clear answer on your next move with T stock, keep reading – we’ve got three things you need to see through the VectorVest stock analysis software before making a decision.

There’s No Denying AT&T’s Timing, But the Safety is Poor…

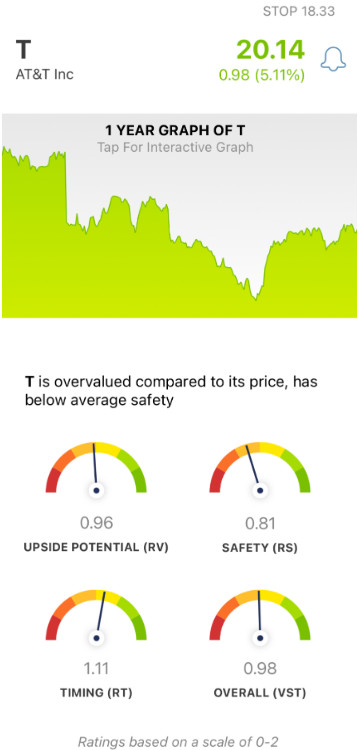

The VectorVest system makes navigating the stock market as simple and straightforward as possible. Rather than spending hours in front of your screen daily tracking complex indicators, you can rely on three easy-to-understand ratings to tell you everything you need to know: relative value (RV), relative safety (RS), and relative timing (RT).

These sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings above the average indicate good performance and vice versa. And based on the culmination of these three ratings, VectorVest provides you with a clear buy, sell, or hold recommendation for any given stock - including AT&T. Here’s what you need to know right now…

- Fair Upside Potential: The long-term price appreciation potential for T is fair in comparison to AAA corporate bond rates and risk - with an RV rating of 0.96, just below the average. However, the stock is overvalued at the current price per share of $20.14 - with a current value of just $16.57.

- Poor Safety: An indicator of risk, relative safety analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for T, the RS rating of 0.81 is poor.

- Good Timing: The one thing T has going for it right now is timing. The RT rating of 1.11 is good and is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating of 0.98 is fair - just below the average. So what does that mean for you - should you buy shares of T, or does poor safety outweigh good timing? Don’t play the guessing game or let emotion influence your decision - get a clear answer on your next move with a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, T has very fair upside potential but it is overvalued with poor safety. However, the timing is good for this stock right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment