Manufacturing giant 3M (MMM) delivered a lackluster performance in the most recent quarter. The company missed expectations for profits – but the real concern is the outlook for the year ahead.

In this quarter last year, 3M recorded a net income of $1.34 billion – or $2.31 a share. This year, the figure was cut by more than half. They reported a net income of just $541 million, which comes out to $0.98 a share.

It wasn’t just profitability that suffered, but sales itself. The company reported a mere $8.08 billion, a step back from the same quarter last year when they reported $8.06 billion.

One way 3M is planning to address the profitability problems is through layoffs. Mike Roman, a chief executive at the company, says to expect 2,500 global manufacturing jobs to be cut. He says this is an important step in getting the company aligned with the adjusted production volumes that are to come this year.

Speaking of which, the real issue with 3M is the grave outlook for 2023. A sales decline of between 2-6% is expected, while EPS will drop as well. All this news resulted in a pre-trading loss of 4% Tuesday morning for 3M. And as of 12 PM EST, the stock has slid 5%. The stock is down over 32% in the last year.

So – if you’re currently invested in MMM, is now the time to sell? You can get a clear answer on what you should do next through the VectorVest stock forecasting tool – take a look below…

Despite Very Good Upside Potential, MMM Has Poor Timing Right Now

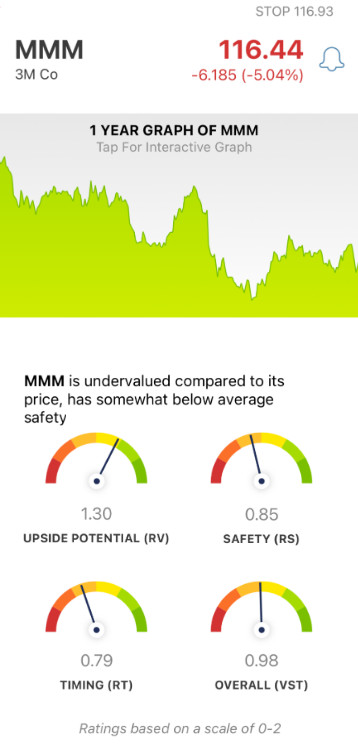

The VectorVest system simplifies your trading strategy by telling you everything you need to know about a stock in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting the ratings is quick and easy, too, as they sit on a scale of 0.00-2.00. With 1.00 being the average, you can win more trades by picking stocks with above-average performance! Better yet, VectorVest can give you a clear buy, sell, or hold recommendation based on these three ratings. You’ll never have to play the guessing game or let emotion influence your decision-making again. As for 3M, here’s the current situation:

- Very Good Upside Potential: Despite the unfavorable outlook for MMM, VectorVest deems the long-term price appreciation potential to be very good compared to AAA corporate bond rates and risk. Along with an RV rating of 1.30, it’s worth noting that the stock is undervalued right now - with a current value as high as $144.40/share.

- Fair Safety: The RS rating is an indicator of risk. It’s calculated based on a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. Right now the RS rating of 0.85 is just fair.

- Poor Timing: The biggest problem for MMM is the poor timing it has right now - with an RT rating of just 0.79. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 0.98 - which is fair but just below the average. So - what does that mean for you? Should you sell the stock, or is now a good time to pick up additional shares at a value? You aren’t going to want to miss this recommendation - get a free stock analysis here to find out…

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, MMM has very good upside potential and is undervalued. However, the safety is below average and the timing is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment