Best Buy (BBY) reported second-quarter earnings early this Tuesday morning that topped the analysis consensus. And yet, the key takeaway from the earnings call is that the electronics retailer is struggling beneath the surface.

After the company strategically set low expectations for this quarter way back in May, the consensus remained low – setting Best Buy up to deliver an earnings beat. The company’s net sales were down 7.2% year over year at $9.58 billion. This narrowly beat the estimate of $9.53 billion.

Meanwhile, profit climbed to 27% compared to 21.5% a year ago and the estimate of 22.61%. The diluted EPS exceeded expectations at $1.22 compared to $1.107, but again, this was a 21% drop from this time last year.

The new consumer environment with sky-high interest rates and inflation has proven to be a challenge for Best Buy. Consumers are more “deal focused” than in recent history, and discretionary retailers like Best Buy are feeling it the most.

Mobile phones, consumer electronics, and appliances all saw sizable sales declines for the quarter. People spent their discretionary income on things like travel this summer over the products Best Buy sells.

And while back-to-school season typically favors companies like Best Buy, it hasn’t been the godsend they were hoping for just yet.

That being said, the company is cautiously optimistic about the future. While Best Buy raised the low end of the full-year EPS guidance, the high end dropped slightly. The company is expecting the soft consumer environment to extend through the holiday season.

Still, shares of BBY climbed more than 5% on the news this morning. After losing 6% in the last month, this turnaround couldn’t have come at a better time. But, with the underlying uncertainty for this company, where does that leave investors? Should you buy, sell, or hold off on BBY?

We’ve uncovered 3 things through the VectorVest stock analysis software that will help you make your decision one way or another.

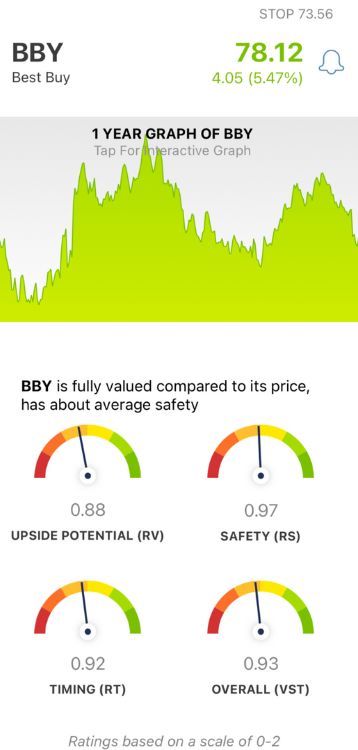

BBY Has Fair Upside Potential, Safety, and Timing Right Now

The VectorVest system is an intuitive stock forecasting software that helps you simplify your trading strategy and win more trades with less work. It’s outperformed the S&P 500 index by 10x over the last 20 years and counting.

This is all possible through a proprietary stock rating system that consolidates everything you need to know into 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy. But, it gets easier - because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation at any given time. As for BBY:

- Fair Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted three years out) and AAA corporate bond rates & risk. And right now, BBY has a fair RV rating of 0.88 - albeit below the average. That being said, the stock is fully valued at its current price.

- Fair Safety: In terms of risk, this is a fairly safe stock - as evidenced by the RS rating of 0.97, just slightly below the average. This rating is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: In looking at the price trend for BBY, it has fair timing - with an RT rating of 0.92, again, just below the average. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.93 for BBY is just shy of the average of 1.00. Where does that leave you - should you buy, sell, or hold this stock?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Even though BBY beat earnings on the top and bottom line, the company appears to be struggling with a challenging economic climate. It has fair upside potential, safety, and timing, though.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment