Shares of Box Inc. (BOX) fell more than 9% when the market opened Wednesday. The company reported second-quarter earnings yesterday after hours and the results were anything but positive.

While revenue did climb 6% to $261.4 million, this was only a hair above the analyst consensus of $261 million. Meanwhile, net income of $10.8 million contributed to an EPS of 36 cents per share. Again, this was barely above the consensus of 35 cents per share.

While the company did beat the consensus narrowly, the real issue is in the weak outlook for not just the current quarter but the remainder of the year. In fact, executives cautioned that an earnings beat is not likely in the near future.

Box is expecting revenue of $261-$263 million for the third quarter, which is well under the target that Wall Street has laid out of $265.6 million. Looking ahead to the rest of the year, Box is projecting revenue just under the consensus of $1.05 billion.

The cloud-based content management provider is optimistic about the long-term prospects of its performance, though. Aaron Levie, chief executive with the company, says that while some companies are seeing immediate benefits from AI, Box will reap the fruits of its labor in the long run with Box AI.

That being said, the clock is ticking for Box to get that product to market. Investors are losing patience as the company has focused on finding new markets and customers with minimal success, and now, all eyes turn to the company’s speed of innovation.

As the stock is now down more than 10% this year, this begs the question…is it time for you to cut losses on BOX as an investor? Or should you weather the storm and wait for the stock to turn around?

The good news is you don’t have to play the guessing game or make a decision based on emotion. We’ve taken a look at this stock through the VectorVest stock analysis software and found something you need to see before you make your next move.

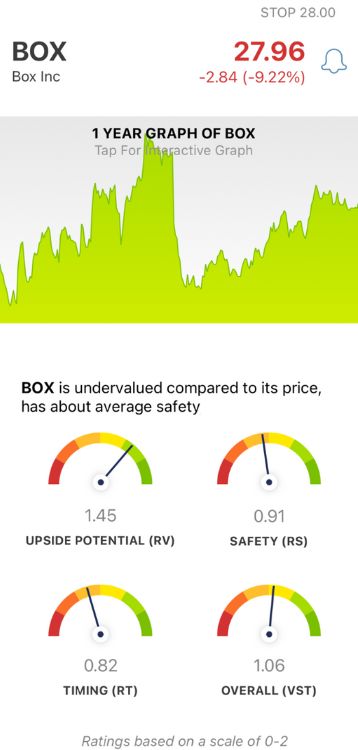

While BOX Has Excellent Upside Potential and Fair Safety, the Timing is Poor For This Stock Right Now

The VectorVest system has outperformed the S&P 500 by 10x over the past 20 years and counting. It saves you time and stress while empowering you to win more trades.

This is made possible through the proprietary stock-rating system, which gives you all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00, with 1.00 being the average. And, based on the overall VST rating for a stock, the system gives you a clear buy, sell, or hold recommendation - at any given time! As for BOX, here’s what we’ve uncovered:

- Excellent Upside Potential: The RV rating looks at a stock’s long-term price appreciation potential (3 years out) compared to AAA corporate bond rates and risk. And right now, BOX has an excellent RV rating of 1.45. Further to that point, the stock is undervalued with a current value of more than $38.

- Fair Safety: In terms of risk, BOX is a fairly safe stock - although the RS rating of 0.91 is slightly below the average. This rating is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity

- Poor Timing: The one thing holding BOX back right now is a negative price trend - which has only been made worse with the latest earnings. The RT rating of 0.82 is poor. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.06 is considered fair for BOX - but where does that leave you as an investor or prospective trader? Does the VectorVest system consider this stock a buy, sell, or hold right now?

Get a clear answer on your next move with a free stock analysis today and make your decision with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite beating earnings this time around, the future is bleak for BOX - which has excellent upside potential and fair safety, but poor timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment