Booz Allen Hamilton (BAH) is among many other AI stocks to make headlines recently. The consulting services firm got a boost after a Bank of America upgrade from neutral to buy. The firm raised its price target from $110 to $130.

The AI company shares its data with the military and intelligence industry. It helps businesses and government organizations alike determine if their AI systems are ethical through data-driven insights.

But what did BoA see that it liked? For starters, the company has the makings of an explosive growth stock. Just last quarter both the top and bottom line saw improvements. Earnings grew 30% to $1.47/share while revenue spiked 18% to $2.65 billion. The company is set to report its fiscal 2nd quarter earnings in just a few weeks.

In other news, Space Force and Booz Allen Hamilton agreed to terms on a $630 million contract for engineering and integration services. Space Force will use the company’s services for missile tracking, surveillance, and reconnaissance and tracking capabilities.

The stock has shown steady growth over the past few years, and is up 18% in the last year alone. It also got a nice boost this week after the upgrade, climbing more than 5% to $115/share.

There is also reason to believe that big funds are buying BAH at a higher clip than it’s being sold according to Business Insider’s Daily. Should you follow suit, though?

We’ve taken a look at the stock through the VectorVest system and uncovered 3 things you need to know before you decide to buy, sell, or hold BAH.

BAH Has Fair Upside Potential and Timing With Good Safety - Is it Time to Buy, Though?

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it. It’s outperformed the S&P 500 index by 10x over the past 20 years and counting. But, the best part is that it does this while saving you time and stress in your investing strategy.

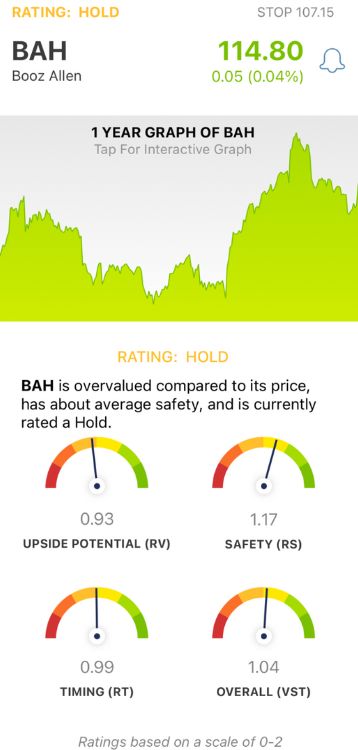

You’re given all the insights you need to make clear, confident decisions in 3 simpler ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average.

You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for a given stock. This means no more guesswork or emotion getting in the way of your profits. As for BAH, here’s what you need to know:

- Fair Upside Potential: The RV rating is a comparison between a stock’s long term price appreciation potential (forecasted 3 years out) and AAA corporate bond rates & risk. It offers much better insights than a simple comparison of price to value alone. And despite being slightly below the average, the RV rating of 0.93 is considered fair.

- Good Safety: The RS rating is an indicator of risk. It’s computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. And right now, BAH has a good RS rating of 1.17.

- Fair Timing: Despite the price trend we see forming today, the timing may not be quite right for BAH. The RT rating of 0.99 is just below the average. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.04 is deemed fair, but what does that mean for you? Should you buy this stock or hold off and wait for a more meaningful price trend to take hold?

VectorVest has placed a “Hold” rating on BAH at this time. Stay up to date to watch for the RT rating to cross over the average of 1.00 and move in the right direction. Get a free stock analysis today to learn more about the system and BAH specifically!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BAH is climbing after getting an upgrade from BoA and securing a massive deal with Space Force. The stock has fair upside potential and timing with good safety, but it’s not quite time to buy yet.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment