While the market is closed this morning on MLK day, the week still started off with a bang as Broadwind Energy (BWEN) soared 27% by 12pm EST.

And while this was enough to get many investors to buy in and ride the wave, this is just part of a larger overall trend that’s been forming for weeks now. The stock is up a whopping 200% in the past month. What caused this massive spike, and is it sustainable? Or, is this just another pump and dump stock?

Experts say the surge for Broadwind came on the heels of their recent $175 million deal to build wind towers for a global wind turbine manufacturer. This is a huge deal for Broadwind, one that will require 50% of optimal tower production capacity across their operation. Moreover, the company will be able to take advantage of a new advanced manufacturing tax credit (per the Inflation Reduction Act).

With that said, this is just one order – and while it will take the company through 2024 to fulfill the job in its entirety, it doesn’t speak to the long-term success of Broadwind. And in looking at the company’s financial performance, analysts are expecting a $0.15/per share loss in the upcoming report.

However, this is an improvement from the previous year. Revenue is expected to come in at 70% higher than this period last year. All of this is to say, Broadwind looks to be headed in the right direction. So – is this stock a buy now? Or, is BWEN overhyped?

While there’s no questioning the price trend this stock has in its sails right now, we have used the VectorVest stock forecasting software to identify two causes for concern investors need to take heed of.

Despite Excellent Timing, BWEN Has Poor Upside Potential and Safety

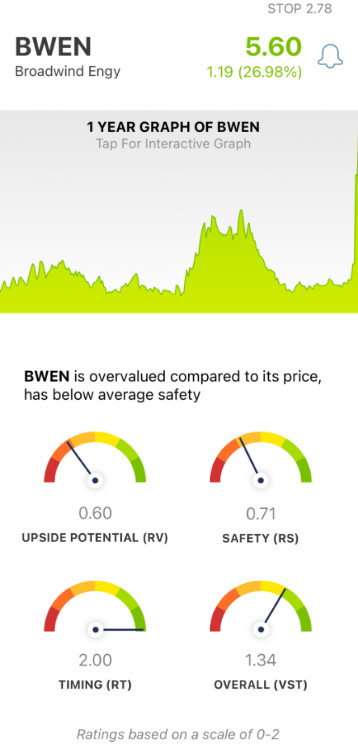

The VectorVest system uses three simple ratings to tell you everything you need to know about a stock. These are relative value (RV), relative safety (RS), and relative timing (RT). All three of these ratings sit on an easy-to-understand scale of 0.00-2.00 – with 1.00 being the average. Ratings over the average indicate superior performance and vice versa.

But the best part is that based on these three ratings, VectorVest gives you a clear buy, sell, or hold recommendation for any given stock – at any given time. As for BWEN, here’s what you need to know…

- Poor Upside Potential: In comparing the long-term price appreciation potential (3 years out) to AAA corporate bond rates and risk, VectorVest deems the upside potential for BWEN to be poor – and the RV rating of 0.60 reflects that. Moreover, this recent price surge has greatly overvalued the stock – with a current value of just $1.91.

- Poor Safety: An indicator of risk, relative safety analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for BWEN, the RS rating of 0.71 is poor.

- Excellent Timing: Of course, there is no denying the excellent timing BWEN has – backed up by the excellent RT rating of 2.00. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All three of these ratings work out to an overall VST rating of 1.34. Does that mean this stock is worth buying now? Does the excellent timing outweigh the poor upside potential and safety? If you’d like a clear answer on your next move with BWEN, get a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for BWEN, it is overvalued with poor upside potential and safety. But, the stock does have excellent timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment