Caterpillar Inc. (CAT) shared its results from the fourth quarter on Monday and shares made their way into the green after an impressive quarter of growth. In fact, the company set a new record for sales after nearly a century in business.

Revenue of $17.07 set a new bar for Caterpillar, representing a 2.8% growth YoY and narrowly outperforming the analyst outlook of $17.06 billion. Interestingly enough, the company saw lower sales volume in Q4 – but this was offset by higher prices and a positive currency translation.

It wasn’t just sales records being smashed, though. Caterpillar also set a new record for adjusted profit margin, adjusted profit per share, and free cash flow. Adjusted EPS of $5.23 was well above the FactSet consensus of $4.76. This continues the trend of outperforming the analyst expectation by 10% or more over the past four quarters.

Meanwhile, net income of $2.68 billion was a massive improvement YOY compared to the $1.45 billion reported last year.

The company expects this trend to continue, as investments in government infrastructure and residential construction will remain healthy. That being said, there are concerns abroad as the Asian economy appears to be softening outside of China. There’s skepticism surrounding Europe’s performance on the road ahead as well.

Perhaps the most exciting takeaway from the call for investors was Caterpillar’s commitment to returning free cash flow to shareholders in the form of dividends and share repurchases. Free cash flow for Q4 came in at $3.2 billion, which was below analyst expectations. The company expects to grow this figure to $5 billion to $10 billion.

While CAT moved marginally on this news, the stock has now climbed 6% in the past week and 11% in the last month. It’s been trending in the right direction for some time, and the stock is fundamentally sound too. That being said, we found 3 compelling reasons to BUY CAT through the VectorVest stocks software.

CAT Has Excellent Upside Potential and Timing With Good Safety

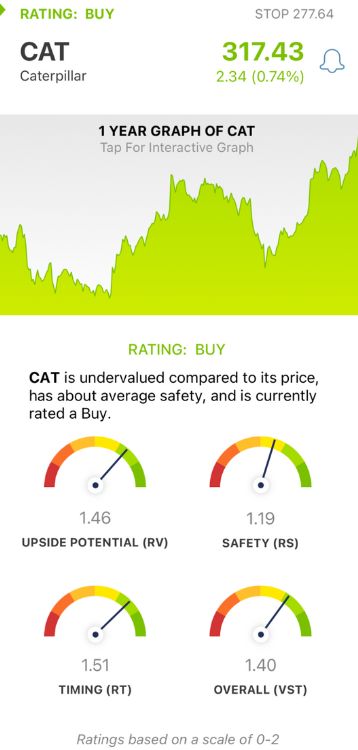

VectorVest simplifies your trading strategy by giving you all the insights you need to make calculated decisions in 3 proprietary ratings designed to save you time and stress.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each of these ratings sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even better, though. The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for CAT, here’s what you need to know:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better assessment than a simple comparison of price to value alone. As for CAT, the RV rating of 1.46 is excellent. Further to that point, the stock is undervalued with a current value of $407

- Good Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.19 is good for CAT.

- Excellent Timing: The RT rating speaks to a stock’s price trend. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As you can see from the stock’s performance in both the short and long term, CAT has excellent timing with an RT rating of 1.51.

The overall VST rating of 1.40 is excellent for CAT, and it’s accompanied by a BUY recommendation for this stock. Don’t miss out on this opportunity to get a free stock analysis at VectorVest and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CAT is climbing on a record-breaking quarter for sales and profits, and performance should remain strong in the near term as well. The stock has excellent upside potential and timing with good safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment