Meta (META) is starting 2024 with a statement, announcing its first-ever dividend after an impressive Q4 driven by a surge in advertising sales. The stock is up more than 20% in Friday morning’s trading session.

The company grew revenue to $40.11 billion, a 25% increase year over year. Net income for the quarter jumped to $14.02 billion ($5.33/share) from just $4.65 billion ($1.76/share) the year prior. Analysts were expecting $30.91 billion in revenue and $4.82/share.

This was the result of a turnaround in advertising sales, which suffered through 2023 on cautious corporate spending. Meta also saw more monetization for Instagram and Reels, alongside AI-fueled ad targeting and measurement that offered a boost in Q4.

Perhaps the biggest takeaway from Meta’s earnings, though, was the announcement of the company’s first-ever dividend payout. On March 26, investors will receive a cash dividend of 50 cents per share. This dividend announcement was coupled with the authorization of a $50 billion share buy-back program.

The company spent the majority of last year honing its profitability, cutting the workforce by 22%. The extra cash coming from the year of efficiency won’t just go back to investors, though. It will be reinvested into AI capabilities for both users and businesses. The company has already made plans to spend between $30 billion and $37 billion this year.

For the current quarter, Meta expects revenue in the $34.5 billion to $37 billion range. This is well above the $33.9 billion analysts are expecting.

However, Mark Zuckerberg and CFO Susan Li both warned of uncertainty surrounding the future, which sparked slight concern. The next 5-10 years will be volatile, with risk factors ranging from geopolitical to regulatory to tech innovation.

That being said, Meta has proven to be a resilient company time and time again. All this news has sent shares towards a record high, up more than 20% today and now 35% through the first month of 2024.

Furthermore, we’ve taken a look at META through the VectorVest stocks software and discovered 3 other reasons that it’s time to buy this stock if you don’t already hold shares.

META Has Excellent Upside Potential, Safety, and Timing

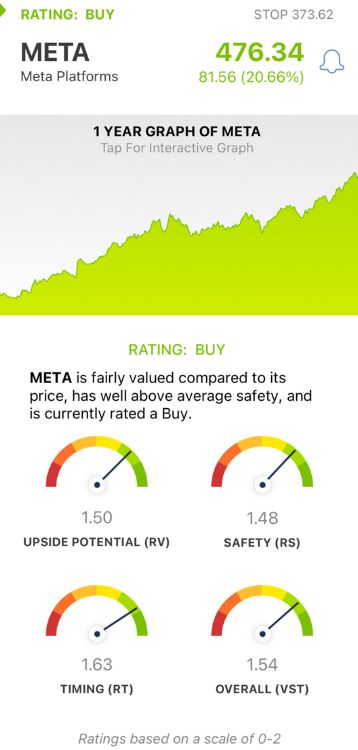

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it. It’s all based on 3 simple ratings that give you all the insights you need: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even better, though. You’re offered a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for META, here’s what we see:

- Excellent Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers much better insight than the typical price-to-value comparison. META has an excellent RV rating of 1.50 right now.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. META has an excellent RS rating of 1.48 right now.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. META has wind in its sails with an excellent RT rating of 1.63.

The overall VST rating of 1.54 is excellent for META, and it’s accompanied by a BUY recommendation in the VectorVest system. You’re not going to want to miss this opportunity - learn more through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. META is up more than 20% today after impressive Q4 earnings accompanied by its first-ever dividend. The stock has excellent upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment