The crypto world is in a tumultuous state after yesterday’s news of Binance and FTX signing a deal to merge. This merger will result in Binance taking over FTX’s non-US unit at a time when FTX struggles with liquidity. Crypto as a whole is down – including Bitcoin.

But today, we’re here to talk about Coinbase – the crypto wallet that was left out of the fun.

We discussed the state of Coinbase about a month ago after a deal was struck with Google. At the time of the Coinbase & Google deal, the bitcoin wallet had enjoyed a nice bump of about 7%. Fast forward to today, and Coinbase has taken a 10% drop so far Wednesday morning after the news of its competitors merging.

It’s worth noting that Coinbase isn’t the only crypto company that’s down after the news. Rumblings of financial trouble at FTX have been pushing prices down for the past few days – as Bitcoin sits about 16% lower today than it did last week. Bitcoin miner RIOT is down 7%.

So – it’s possible that a chunk of this loss Coinbase is seeing could rebound as the market settles. However, analysts do have concerns over what the FTX & Binance merger could mean for Coinbase’s longevity.

While Binance and FTX aren’t considered direct competitors to Coinbase, the competitive landscape will never be the same. These two companies combined will command massive market share, creating a “powerhouse in crypto trading” as one analyst puts it. Perhaps the biggest concern is that these two companies are in a position to dominate the global market now – an area that Coinbase was looking to expand into.

On the other hand, one analyst – MoffettNathanson Partner Lisa Ellis – believes this merger could actually be good for Coinbase. She is optimistic that the merger could lead to a flight to higher-quality platforms – like Coinbase.

It remains to be seen what the next few days, weeks, months, and years will look like for crypto. Nevertheless, you want to know what your next move should be with Coinbase. Is now the time to sell? Or, should you wait to see if the stock recovers after the noise settles down a bit? The VectorVest stock analysis tools can give you a clear answer – keep reading to learn more…

3 Major Problems with Coinbase Stock Investors Need to See

VectorVest simplifies trading forever by compiling everything you need to know about a stock into three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is as straightforward as it gets. They sit on a scale of 0.00-2.00 – with 1.00 being the average. Anything over 1.00 indicates superior performance and vice versa. But most importantly, VectorVest provides you with a clear buy, sell, or hold recommendation based on these three ratings.

Mergers aside, VectorVest sees three major problems with Coinbase stock right now. Here’s the current situation:

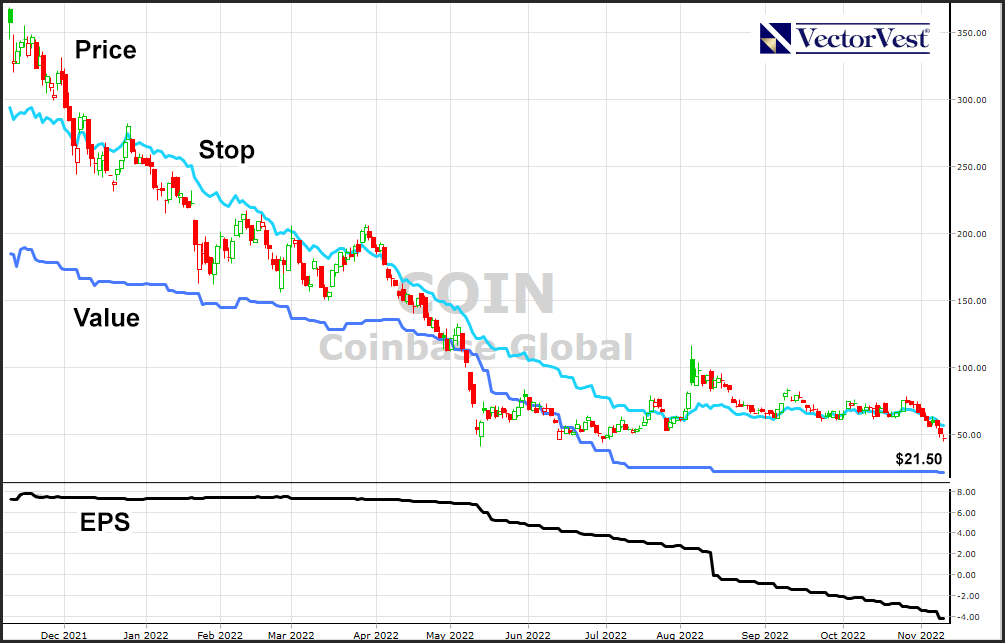

- Poor Upside Potential: The long-term price appreciation potential three years out is poor for COIN – and the RV rating reflects that at just 0.51. This is coupled with an overvaluation of the stock. VectorVest calculates a current value of just $21.50 compared to the current price of $45.75.

- Poor Safety: RS is an indicator of risk. It looks at a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for COIN, the RS rating of 0.61 is poor.

- Very Poor Timing: The biggest problem at COIN right now is the negative price trend pushing the stock lower and lower – and the latest news certainly hasn’t helped. The RT rating looks at a price trend’s direction, dynamics, and magnitude. It calculates the rating based on trends day over day, week over week, quarter over quarter, and year over year. All that said, the RT rating of 0.24 is very poor.

Now – taking all three ratings into account, the overall VST rating for COIN is very poor at just 0.47. Does that mean you should sell any remaining shares you have? Or, is there any reason to hold on while the chaos subsides? Get a clear answer through a free stock analysis here – you’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for COIN, it has poor upside potential & safety with very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment