Columbia Care Inc. (CCHWF) started the week with a bang, releasing its 1st quarter earnings report and exceeding analyst expectations. As a result, the stock has climbed more than 20%. But as you’ll discover below, there are still 3 major issues investors should be aware of.

The cannabis company posted revenue of $124.54 million, which beat out the FactSet consensus of $123.1 million. Still, the company reported a $37.34 million loss for the quarter – which was steeper than anticipated. Last year, the company reported a loss for this quarter of just $26.64 million. It seems as if profitability challenges are only getting worse.

Nevertheless, the company remains optimistic about completing a sale to industry giant Cresco Labs. With that said, there is no timeline for completing the deal – so investors shouldn’t hold their breath over an acquisition.

Looking ahead, Columbia Care is anticipating capitalizing on Virginia, Maryland, and New Jersey adult-use cannabis markets, as these offer substantial potential for growth. And, the company is looking to expand into the New York and Delaware markets.

On top of all this, Columbia Care extended the maturity of $38 million+ senior secured notes to May 2024, while divesting non-core and unprofitable assets. As you can imagine, this is all in response to the widened loss the company experienced this quarter. The goal is to save $35 million annually in the near future.

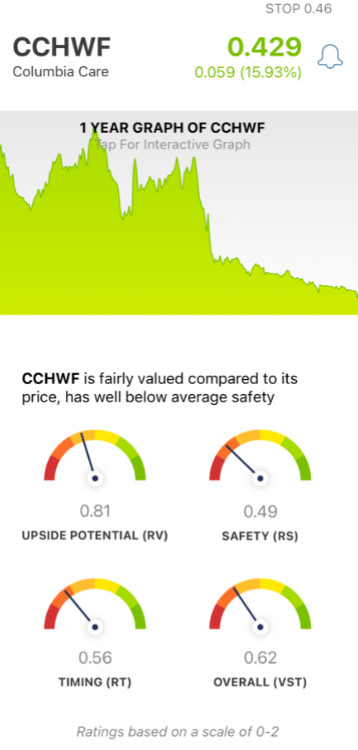

Today, the stock sits at just $0.44/share. Less than 6 months ago, CCHWF sat at $1.85/share. While the company did outperform in terms of revenue, there are clearly concerns that need to be addressed. If you’re invested in CCHWF, you’ll want to see these 3 red flags we’ve uncovered through the VectorVest stock analyzing software…

CCHWF Has Poor Upside Potential and Timing With Very Poor Safety

The VectorVest system simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it. The best part? You’re given all the insights you need to arrive at these decisions in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, with 1.00 being the average - allowing for quick and easy interpretation. But based on these ratings, the system is able to give you a clear buy, sell, or hold recommendation for any given stock, at any given time. As for CCHWF, here’s what you need to be aware of:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. Right now, CCHWF has a poor RV rating of 0.81. With that said, the stock is fairly valued at its current price.

- Very Poor Safety: In terms of risk, this stock has very poor safety. The RS rating of 0.49 is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: In terms of price trend, it’s clear to see that CCHWF has been on a downward trajectory for some time - and even with the quick bump today, the stock still has poor timing. The RT rating of 0.56 is calculated from the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All of this contributes to an overall VST rating of 0.62 - which is poor. So, does that mean you should cut losses on CCHWF and sell your shares? Or, is there any reason to hold onto hope for an acquisition? Get a clear answer on your next move with a free stock analysis today at VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite beating revenue estimates, CCHWF still has poor upside potential and timing along with very poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment