Delta Air Lines has doubled down on the momentum that’s been growing for them over the past few months. Early Wednesday morning they put out a press release stating that their “recession is over”. The post-pandemic travel boom is just beginning.

Executives state that it’s unlikely the company will ever see the same level of travel from 2019. However, they are reporting 80% of business travel from that period – with small business showing even stronger demand than 3 years prior to the pandemic. As a result, Delta has raised guidance on their Q4 earnings from the previously forecasted $1.00-$1.25 up to $1.35-$1.40.

Moreover, the company expects this momentum to travel through 2023 – with the goal of having their network completely restored by next summer. As such, they’ve forecasted a 15%-20% jump in revenue in 2023 (up from the $45.5 billion projected this year).

While other industries warn of a weakening economy which points towards recession, Delta and other airline companies are more upbeat than ever. And, investors are upbeat on Delta stock after this news – sending shares almost 4% higher in Wednesday trading.

Does this mean there is a good opportunity for you to trade Delta at the current price of $34.60/share? If what Delta is forecasting proves true, this could be a great value buy.

To help you make your next move with confidence, we’ve detailed the most important elements of DAL stock below through the VectorVest stock forecasting tool. We found 2 key insights that could make this a favorable opportunity. Here’s what you need to know…

Excellent Upside Potential & Very Good Timing for DAL Stock Make it an Opportunity Worth Looking into…

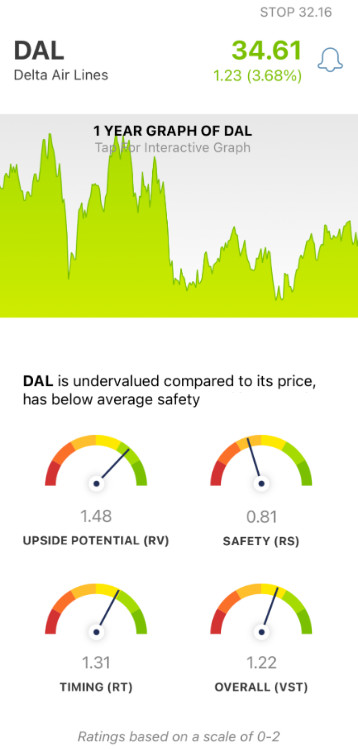

The VectorVest system changes the way you trade for the better. It tells you everything you need to know about a stock in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Gaining insights from these ratings is fast and straightforward, as they sit on a simple scale of 0.00-2.00. Pick stocks with ratings above the average of 1.00 and win more trades!

Making things even easier, the VectorVest system provides you with a clear buy, sell, or hold recommendation based on these ratings. No more guesswork, no more emotion clouding your judgment. As for DAL, here’s the current situation:

- Excellent Upside Potential: The long term price appreciation potential doesn’t just look favorable in the eyes of DAL executives – VectorVest sees excellent upside potential, too. The RV rating of 1.48 reflects that. Moreover, the stock is undervalued at the current price of $34.60 – the current value is $46.91.

- Poor Safety: The one red flag with DAL stock is risk. The RS rating of 0.81 is poor. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: In terms of price trend, DAL has very good timing – and the RT rating of 1.30 backs up what we’re seeing in the stock’s price in the past weeks & months. This rating is calculated based on the trend’s direction, dynamics, and magnitude. It’s analyzed day over day, week over week, quarter over quarter, and year over year so you have the full viewpoint.

All of this works out to an overall VST rating of 1.22 – which is good. Does it earn DAL a buy in the VectorVest system, though? To get a clear answer on your next move with this stock use our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for DAL, it is undervalued with excellent upside potential and very good timing, but it does have poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment