Tesla continues to be put on the back burner as Elon Musk dedicates his attention – and now, his resources – to Twitter. Since purchasing the social media platform for roughly $44 billion, Tesla has slowly but surely started to fall. And investors are finally starting to ask – is now the time to sell?

This morning, Elon Musk announced that he has sold another $3.6 billion in Tesla stock – a whopping total of 22 million shares. Now, the total Tesla stock cashouts sit at just under $40 billion as Musk has essentially financed his Twitter purchase with Tesla shares.

In April, Elon reported that he would not sell Tesla shares – which has proven false. This begs the question – just how much of Tesla’s livelihood is he willing to sacrifice in his endeavor to build Twitter?

Tesla investors are frustrated, and rightfully so. One analyst at IG Markets points out that these types of moves show where Elon’s attention is – and how little confidence he has in Tesla. This brings up a memory from Elon’s interview with Joe Rogan where he expressed the frustration and challenges of keeping a car company alive. With these recent moves, it begs the question…is Twitter his way out of Tesla?

Not only does Tesla appear to be at sea without a captain. But, some analysts fear that the inflammatory decisions and tweets Elon is making with Twitter will slowly devalue the Tesla business as well.

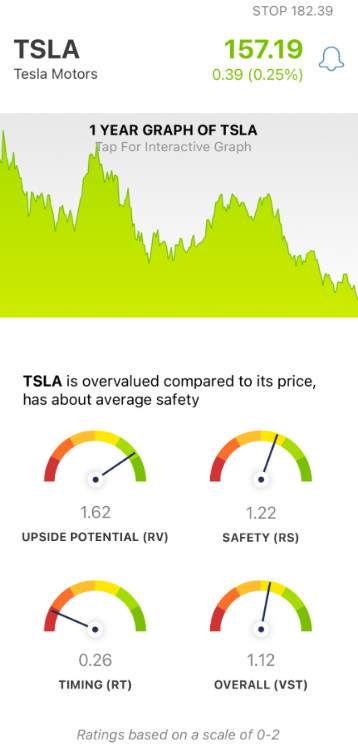

If you’re currently invested in Tesla, you want to know if this is your sign to get out while you still can. Or, maybe you’re a speculative investor wondering if this low price point of $157 is a good value to buy in for when the stock starts to turn around. We’ve identified the one thing that’s really holding Tesla back right now through the VectorVest stock analysis system…

Despite Excellent Upside Potential and Good Safety, TSLA Has Very Poor Timing Right Now

The VectorVest system simplifies trading by telling you everything you need to know about a stock in just three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is as straightforward as it gets. They sit on a scale of 0.00-2.00 – with 1.00 being the average. Pick stocks with above-average ratings to win more trades! As if the system wasn’t foolproof enough, VectorVest even provides you with a clear buy, sell, or hold recommendation based on these ratings. As for TSLA, here’s the current situation:

- Excellent Upside Potential: Taking a look at the long term price appreciation potential, TSLA has an excellent RV rating of 1.62. While the stock sits at a very low price point today, there is plenty of room for growth with TSLA – as long as Musk doesn’t get in its way.

- Good Safety: An indicator of risk, the RS rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for TSLA, the RS rating of 1.22 is good.

- Very Poor Timing: The one thing holding TSLA stock back right now is the very poor price trend that’s formed since September of this year. The stock is down almost 50% in the last 3 months, and the very poor RT rating of 0.26 reflects this. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement. As Elon continues to make poor decisions – like cashing out shares of TSLA stock – this trend will continue.

All things considered, the overall VST rating for TSLA is 1.12 – which is good. But does that mean it’s worth holding on – or is it finally time to cut losses? Get a clear answer through our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TSLA, it is overvalued with excellent upside potential and good safety, but it does have very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment