It’s been a relatively quiet Monday in the stock market – with Disney being one of the few exceptions. This morning, news of an internal shake-up has made waves throughout both the entertainment and financial industries.

After 2 years of underwhelming results under CEO Bob Chapek, the company has parted ways and brought back Bob Iger – the previous CEO at Disney for 15 years (2005-2020). And as a result, shares of Disney stock are trading about 7% higher so far this morning. And in just a few moments, we’re going to unveil a few key pieces of information investors need to know about Disney stock. First – what exactly caused this move at Disney?

Chapek was relieved of his duties after a few disappointing quarters – but the recent quarterly earnings report was the nail in his coffin. Disney missed expectations in both profit and revenue, which is not an outcome the company is used to.

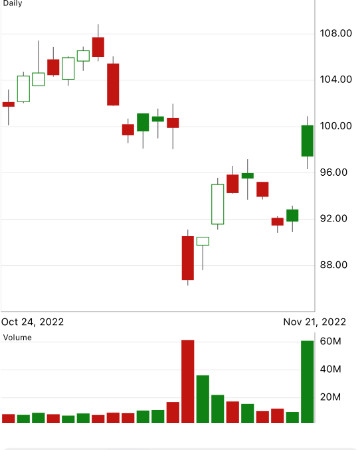

While company stock reached its peak under Chapek back in 2021 at just under $200/share, it’s been in a steady downfall since. As of today, the stock is still down 35% in the past year at just half of what it was back in 2021 – $98/share. The runway Disney gave Chapek was short – but this move was perhaps less about his performance and more about Iger’s potential.

Iger was adored by Disney employees worldwide during his tenure from 2005-2020. In fact, Chairman Susan Arnold expressed her excitement for his return – claiming Iger has the deep respect of Disney’s senior leadership team. She doubled down on this sentiment, claiming that the company’s robust pipeline of content is a testament to his leadership and vision.

Looking ahead to the horizon, plans for Disney include an immediate focus on growing profitability. Part of this will be cutting costs in the form of layoffs, as we’re seeing more and more across the entire economy right now.

But, there is also a focus on bringing in additional revenue through an ad-supported tier – similar to what Netflix is doing. Coming next month (December 2022), the basic Disney+ service will remain at a $7.99 price point – but will now feature ads, helping bring in revenue for the company. To enjoy streaming ad-free, users can upgrade to a $10.99 tier. Either way, Disney executives expect this to move the needle and turn the stock back in the right direction.

For now, though, investors are wondering – is this a good time to get into Disney stock ahead of what’s to come under Iger’s leadership? Or, should you wait for the noise to die down a bit and see what’s waiting on the other side? VectorVest’s stock analysis tools can provide you with a clear answer on what your next move should be – here’s the scoop…

Three Stock Ratings You Need to See Before Making a Decision on Disney Stock

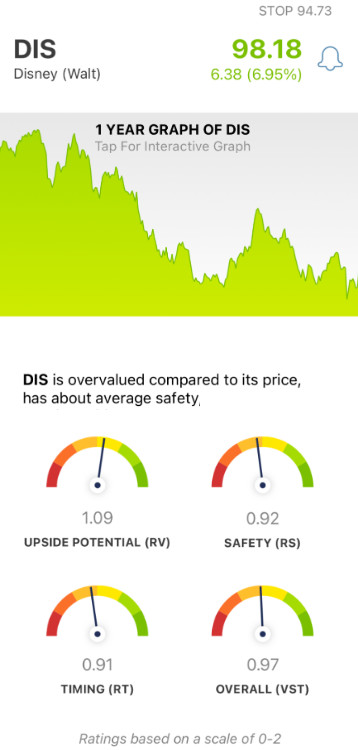

VectorVest has changed the game for investors. Now, you can learn everything you need to know about a stock at just a glance. The system eliminates guesswork and emotion from your strategy – along with complex, long-winded stock analysis. Now, you can simply rely on these three ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These sit on a scale of 0.00-2.00 – with 1.00 being the average. The higher the rating, the better – and vice versa. But the best part is that based on these ratings, VectorVest is able to provide you with a clear buy, sell, or hold recommendation – so you can feel confident making trades based on sound investment principles. As for Disney, here’s the current situation:

- Fair Upside Potential: The RV rating looks at a stock’s long-term price appreciation potential 3 years out. And this morning, Disney has a fair upside potential of 1.09 – right above the average. With that said, VectorVest does deem DIS to be overvalued at the current price – with a current value of just $64.43.

- Fair Safety: An indicator of risk, the RS rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. Right now, the RS rating of 0.92 is fair for Disney – just below the average.

- Fair Timing: This rating is an indication of a price trend. It considers the direction, dynamics, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year. Right now the RT rating for Disney is just fair at 0.91. However, we’re watching this rating gravitate closer and closer to 1.00 in real time. As it crosses over, it will show a positive price trend forming with the wind in its sails – so keep watching closely!

All things considered, the overall VST rating for DIS is just 0.97 – which is fair. This begs the question…is it time to buy or sell DIS? Or, should you keep waiting to see what happens in the coming days & weeks? You don’t have to wonder any longer…get a clear answer on your next move with a free stock analysis here

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for DIS, it is overvalued with fair upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment