It seems Amazon is on a mission to gain a grasp on any industry possible. So, when rumors circulated that Amazon was looking to acquire EA sports, it made sense. With EA Sports being regarded as one of the largest video game companies in the world as it stands right now, this purchase would have taken them to the next level. News of the potential acquisition caused the stock to rise up nearly 15% in pre-market trading – but eventually settled around 6.5% at about $136.

Now, it appears that no acquisition will take place anytime soon. However, it wouldn’t be the first time a tech company purchased a video game company. At the start of 2022, Microsoft acquired Blizzard – another video game company. With that said, an EA acquisition would be far more intriguing because of where EA stands in the market. They’re undoubtedly the largest video game company in the game right now. And even just the mere idea that Amazon could be interested in acquisition has investors wondering if they should buy EA stock at this time. However, VectorVest’s stock forecasting system has EA rated a hold at this time. There is one key reason why: timing.

The Timing Isn’t Right for EA: Despite Solid Upside Potential & Safety Ratings

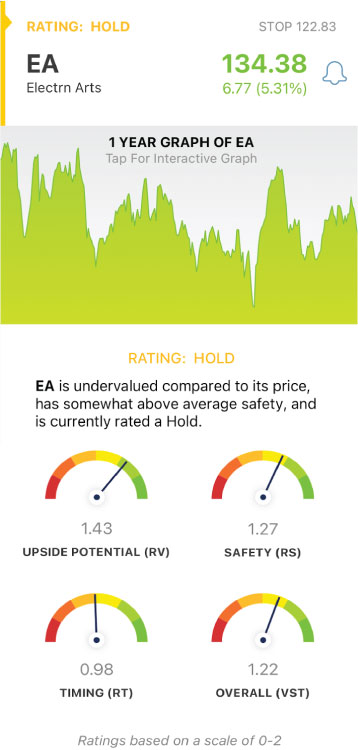

Our stock forecasting tool charts and ranks stocks based on three proprietary ratings: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). These ratings sit on a scale of 0.00-2.00 – and the closer to 2.00, the better. Together, these makeup the overall VST rating a stock is given. And when it comes to EA, the VST rating is good – 1.22. Yet, our system rates the stock a hold at this time. Let’s look at the individual ratings to see why.

The upside potential for EA is excellent – with an RV rating of 1.43, the long-term price appreciation potential for this stock is high. EA also has a forecasted earnings growth rate of 22%, which the VectorVest system deems to be excellent as well. Furthermore, EA has very good relative safety – with an RS rating of 1.27. This rating is calculated from an analysis of the consistency & predictability of the company’s financial performance – and speaks to the risk a stock carries.

If you were just looking at the RV and RS ratings, EA stock looks to be worthy of buying right now – but the one thing holding it back is timing. The RT rating is 0.98 – which is just fair. An RT rating less than 1.00 suggests a negative price trend. As this RT rating drifts across 1.00 and starts trending closer to 2.00, investors can feel more confident buying EA stock. This will reflect a trend in the right direction. For now, though, EA stock has been rated a hold in the VectorVest system.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for EA, it has excellent upside potential and is a relatively safe stock – but it’s not rising in price, so investors should wait for the trend to turn around.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment