After a brutal last few trading sessions for First Republic Bank, it appears the road to recovery may be underway – as the stock is up 50% so far Tuesday. This came after the company witnessed share prices tank down to under $20 a share Monday for the first time in more than 5 years.

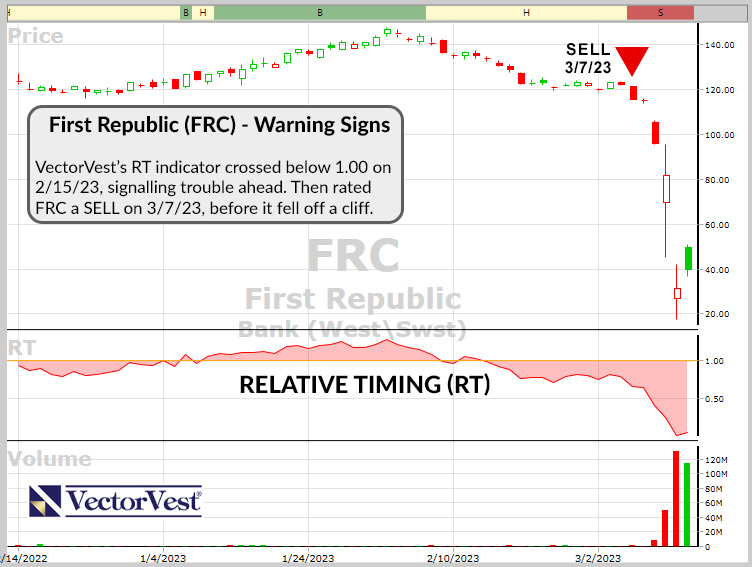

While US regulators attempted to curb the effects of the Silicon Valley Bank run for other banks through backstopping efforts, investors still reacted negatively to the debacle. While other banking companies took steep steps backward in the last few trading sessions, First Republic led the way with a 68% loss on the market between March 9th and March 13.

Throughout this frenzy, it was more or less business as usual at First Republic Bank according to executive chairman Jim Herbert. He said there were no big outflows – and mentioned that additional liquidity came in through JPMorgan and the Federal Reserve in an effort to quell investor/customer fears.

One thing that may be responsible for the rebound we witnessed across the banking industry as a whole is the announcement of the Fed’s Bank Term Funding Program. This will help banks gain access to more liquidity by exchanging certain high-quality assets for cash – without being forced to book mark-to-market losses.

This is certainly a sigh of relief for banks as a whole, and especially First Republic Bank. In the last week, the company has still lost 60% of its value, though, and investors are rightfully skeptical about maintaining their positions in this company. Does this rally mean there is still hope for those who are invested? Or, if you aren’t currently in FRC, is this your sign to get in at a lower price before the stock fully recovers?

We’ll take a look below through the VectorVest stock analyzing software to help you determine your next move. There are three things you need to see before you do anything else…

Despite Excellent Upside Potential and Fair Safety, the Timing is Still Very Poor for FRC

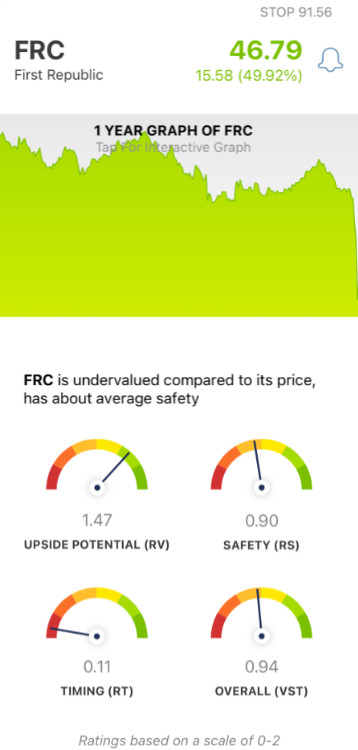

The VectorVest system helps you simplify your trading strategy by giving you all the insights you need to make informed, calculated decisions in just three ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is as straightforward as it gets. Each sits on its own scale of 0.00-2.00, with 1.00 being the average. But the real kicker is that based on these ratings, VectorVest is able to provide you with a clear buy, sell, or hold recommendation – for any given stock, at any given time. Below, we’ll unpack the current situation for FRC to help you find your next move:

- Excellent Upside Potential: After the dramatic losses FRC has experienced over the past few days, the long-term price appreciation is excellent – with an RV rating of 1.47. This is calculated by comparing the stock to AAA corporate bond rates and risk to give you a better understanding of the true value of a stock. As it currently stands, FRC is undervalued – with a current value closer to $105.19.

- Fair Safety: Even with the negative buzz around banks in general after SVB, FRC is still fairly safe – with an RS rating of 0.90. This rating is derived from the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: The one major problem with FRC right now is the very poor timing it has – the current RT rating is just 0.11. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. While the price certainly moved in the right direction today, there is much work to be done before a strong positive price trend is solidified.

All things considered, the overall VST rating for FRC is fair at 0.94. So – does excellent upside potential outweigh very poor timing? Or is it the other way around? Don’t play the guessing game or let emotion influence your decision-making on this stock. Get a clear buy, sell, or hold recommendation and execute your next move with confidence by getting a free stock analysis today

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, FRC has excellent upside potential and fair safety, but it does have very poor timing after the 80%+ losses incurred over the past few days.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment