Back in April of 2020, the world’s second-largest automaker – General Motors – made the decision to cut its dividend payouts. This decision came at the height of the COVID-19 pandemic when companies were hit the hardest. In February of 2020, the company paid out a dividend of 38 cents. And on September 15, 2022, they’ll issue a 9-cent dividend to shareholders of record on August 31, 2022.

That’s not all you’ll find in GM news, though. The company is also reinstating its share repurchase program that was suspended. Not only are they resuming the program, but they’re also ramping it up from $3.3 billion to $5 billion. All of this comes as the result of GM setting its sights on the future. They plan to invest over $35 billion through 2025 to take the company to the next level – with hopes of taking the title from Toyota of largest automaker by sales volume.

What exactly are the initiatives that will help make this a reality? Right now, the company is excited about its electric delivery vehicles – a fleet that already has backing by FedEx, Walmart, and Verizon. And, from a retail standpoint, the latest rollouts have also been very well received. The Cadillac Lyriq and the GMC Hummer EV Pickup are the first two vehicles developed and launched on the GM Ultium platform. That’s not all, Cruise – a GM-owned subsidiary company – has launched a fully driverless commercial ride-share service in San Francisco.

The Momentum Forming for GM Stock Has Earned it a Buy Rating in the VectorVest System

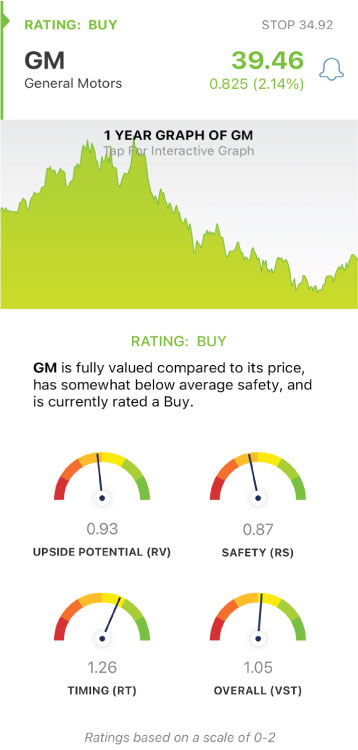

Looking at GM stock, you may not see anything jump out at you that earns the company a buy rating. The upside potential is just fair – and the relative safety is right around average as well. So, what makes this stock a buy, exactly? The VectorVest stock analysis tool goes above and beyond typical stock rating software and technical analysis. VectorVest’s proprietary ranking system takes into account all major fundamental and technical data and boils it down into three easy-to-understand indicators: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). Together, these make up the overall VST rating for a stock. And the rating that really intrigues us right now is the relative timing for General Motors.

The company’s stock peaked early this year – reaching a high of $65/share on January 4. Since then, the company has seen a gradual fall to the bottom. It reached a low point of $30 in the first week of July. Since then, it has rebounded – and currently sits right around $40. Over the past weeks, we’ve seen the RT of GM trending in the right direction. VectorVest’s RT rating is based on an analysis of the direction, magnitude, and dynamics of a stock’s price movements. Like all our ratings, RT sits on a scale of 0.00-2.00. The closer to 2, the stronger the trend. And right now, GM has an RT of 1.26 – which is very good! This has earned the stock a buy rating within the VectorVest system with an overall VST rating of 1.05. With that said, this stock has a poor comfort index – suggesting it struggles resisting severe or lengthy price declines. If you decide to open a position in GM, VectorVest suggests setting a stop loss of $34.92 is advised. You can also protect yourself by tracking the RT rating – if it gravitates back towards 1.00, this suggests the trend we currently see is dissipating.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis software and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for General Motors, it has fair upside potential with below average safety – but the timing is very good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment