A Canadian pension fund (Public Sector Pension Investment Board) recently made dramatic changes to its portfolio. PSP Investments currently manages over $180 billion in assets, so this news has investors scratching their heads, wondering if they should follow suit.

After cutting positions in three top tech companies – Apple, Tesla, and Microsoft – they loaded up on the retail side. They sold almost 500k shares of Microsoft, 70k Tesla shares, and almost 700k Apple shares. In doing this, they made room in their portfolio to purchase roughly 150k shares of Walmart – ending the quarter with just shy of 900k shares.

While Walmart slipped up in the first two quarters – as did most retail corporations – they are already up 13% through the first month and a half of the 3rd quarter. The stock has slowly been climbing back up since it fell off a cliff in May of this year. In just a few days, the stock dropped from over $150/share to under $120/share. The rebound is likely the result of impressive 2nd quarter earnings after a dismal 1st quarter. Total revenue was up 8.4% at $152.9 billion, with the most impressive growth coming in their eCommerce and food sectors. Analysts suggest this could be the result of consumers looking for more budget-friendly options to keep up with inflation and soaring fuel costs. The retail giant reported profits of $5.1 billion – up 20% from this time a year ago. If inflation continues to rise, it’s likely Walmart will continue to benefit – being the loss leader in the retail industry.

But – what does all this mean for investors? Should you follow PSP Investments’ lead and buy Walmart? VectorVest’s stock forecasting system has Walmart rated as a buy now. There are a few reasons why, but one particular indicator stands out – keep reading to learn more.

Good Timing Makes Walmart a Buy in the VectorVest System

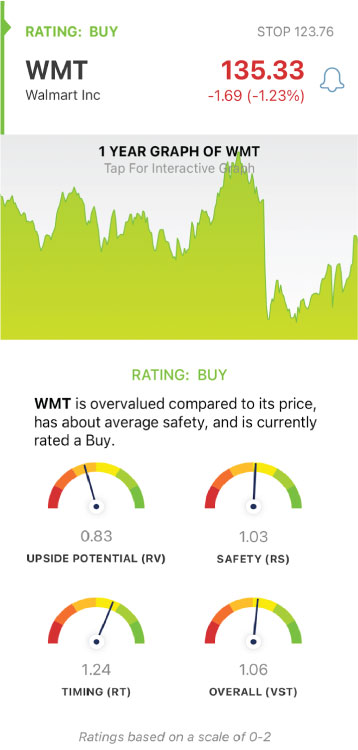

The VectorVest system makes investing simple by boiling down fundamental and technical analysis into three easy-to-understand ratings: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). These ratings tell you everything you need to know about a stock – at any given time. On a scale of 0.00-2.00, you can quickly determine how a stock is performing compared to the average. And while Walmart’s overall VST rating is just fair, the timing is good right now.

RT analyzes a stock’s price trend – taking into account the direction, magnitude, and dynamics day-over-day, week-over-week, etc. The closer the number gets to 2.00 – the stronger the trend. And right now, Walmart has a good RT rating of 1.24. They also have a good forecasted earnings growth rate of 7%. While the long-term price appreciation potential for Walmart is poor with an RV of 0.83, the safety of this stock is fair with an RS of 1.03.

All things considered, Walmart has been rated a buy in the VectorVest system. Because this rating primarily comes from the strong price trend, it is particularly important for investors who enter a position (or who are currently invested) to continue monitoring the RT. If this RT figure starts to drift back towards 1.00, it suggests the trend is weakening – and a reversal could be coming. Because the CI (comfort index) for this stock is poor, the VectorVest system suggests protecting yourself with a stop price of $123.84.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for Walmart, it has poor upside potential and just above average safety – but, the timing is good right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment