In the latest AI news, Google has introduced its take on ChatGPT, known as Bard. The parent company, Alphabet, experienced an 8% drop in the stock price as a result of this news – but why? Shouldn’t an exciting new feature like this cause a lift in share prices if anything?

The issue is, AI has its problems still. These technologies simply regurgitate existing information – and as we all know, much of the information online is inaccurate. If not blatantly false, these results can at least exhibit bias from the sources they’re taken from. This means that these AI chatbots are trained on a lot of bad information – and AI will exacerbate the spread of this misinformation.

Google wanted to be quick to roll out its own chatbot to compete with ChatGPT. And in their haste, they debuted a video of Bard in action – except, it floundered. The response it returned was inaccurate, and Google used this example in its marketing efforts.

The prompt shown was: “What new discoveries from the James Webb Space Telescope can I tell my 9-year-old about?”. The responses appeared to be just fine at first glance until people noticed that the answer was flat-out false. Bard claimed that the telescope was known for taking the very first pictures of a planet outside our solar system. That accomplishment actually belongs to the European Southern Observatory’s Very Large Telescope.

This isn’t the only issue with Google’s new AI chatbot. There is concern over how AI will affect Google’s ability to generate revenue. If AI replaces actual search results, what incentive do businesses have to advertise on Google – let alone publish content in the first place?

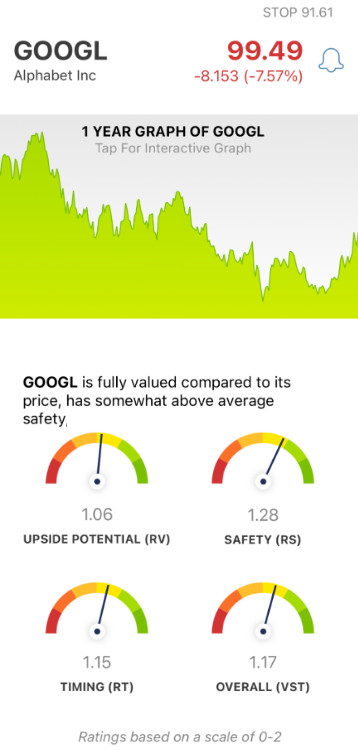

As a result of all this, Google experienced one of its worst trading sessions since last fall. But – is this an overreaction to a simple fluke? Or is it indicative of bigger issues to come in the future? As an investor, you want to know where GOOGL fits into your portfolio – whether you should buy, sell, or hold off. And through the VectorVest stock analyzer software, you can get a clear answer right now.

Despite the AI Debacle, GOOGL Still Has Fair Upside Potential, Good Timing, and Very Good Safety

The VectorVest system will transform the way you approach stock analysis - saving you time and increasing your success rate. It tells you exactly what to buy when to buy it, and when to sell it - eliminating emotion, guesswork, and human error from your strategy.

It’s all based on a proprietary stock rating system that utilizes three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00, with 1.00 being the average. And based on these ratings, you’re given a clear buy, sell, or hold recommendation for any given stock, at any given time - including GOOGL:

- Fair Upside Potential: In comparing GOOGL’s 3-year price appreciation potential to AAA corporate bond rates and risk, it still has fair upside potential - and has earned an RV rating of 1.06. It’s worth noting that the stock is fully valued at its current price point.

- Very Good Safety: GOOGL is a very safe stock, as indicated by the RS rating of 1.28. This is based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Good Timing: Despite the 8% slump GOOGL felt in today’s trading session, it still has good timing - with an RT rating of 1.15. This is calculated from the direction, dynamics, and magnitude of the stock’s price movement. Trends are assessed day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 1.17 - which is good. So, should you buy GOOGL now that it sits 8% lower and offers a better value? Or, should you exercise caution until the company works out the AI kinks? Don’t play the guessing game - get a clear recommendation on your next move with a free stock analysis here

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, GOOGL is fully valued with fair upside potential, very good safety, and good timing - even after falling 8% Wednesday.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment