Yesterday, T-Mobile stock (TMUS) closed at nearly a 5% loss, marking the third consecutive day of losses. This all came after T-Mobile delivered a mixed earnings report last week where some segments performed well and others suffered.

While earnings exceeded expectations from Wall Street, sales figures were a dramatic underperformance. Moreover, the company expects 2023 to be a step backward in customer additions – with a guideline of 5-5.5 million this year compared to 6.4 million last year.

But beyond the company’s own control, the wireless industry as a whole looks to be preparing for a huge slowdown. Even still, T-Mobile underperformed compared to its competitors Verizon and AT&T, each of which lost only 0.55% and 1.26% respectively yesterday.

And as a result of all these various factors, T-Mobile was recently downgraded by an analyst at MoffettNathanson, a division of SVB Securities. Craig Moffett moved his stance on the stock from “outperform” to “market perform”.

His biggest concern right now is subscriber growth. Moffett claims that industry growth rates and company expectations are not matching up – and is going to lead to what he refers to as the “great deceleration” in the wireless industry as a whole. With that said, Moffett still likes T-Mobile as the premier wireless carrier stock right now – edging out its competitors slightly.

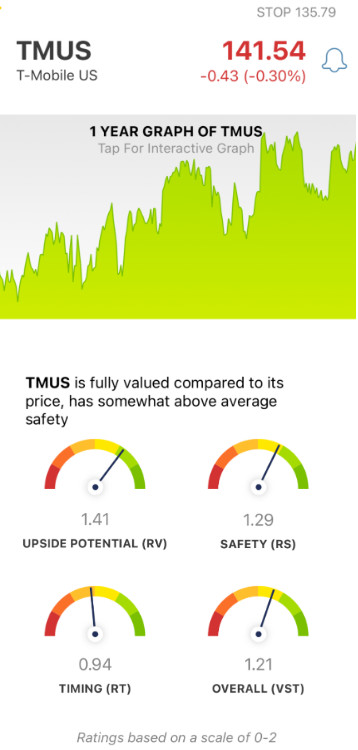

In saying that, TMUS stock has seen steady growth in the last year period – up nearly 17% despite the step backward in the last week or so. If you’re invested in this stock or are looking to get in, you’re probably wondering if all this means it’s time to sell rather than buy. You can get a clear answer on what your next move should be with TMUS stock through the VectorVest stock analyzing software below.

Despite the Temporary Hiccup, TMUS Still Has Excellent Upside Potential and Very Good Safety

The VectorVest system makes finding and analyzing investment opportunities quicker and easier than ever. You’re given all the insights you need to make clear, confident, and emotionless decisions in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on an easy-to-understand scale of 0.00-2.00, with 1.00 being the average. Ratings above the average indicate overperformance and vice versa. Better yet, VectorVest provides you with a clear buy, sell, or hold recommendation based on these ratings for any given stock at any given time. That includes TMUS - here’s what we see happening right now:

- Excellent Upside Potential: the RV rating is a comparison of a stock’s long-term price appreciation potential compared to AAA corporate bond rates and risk. As for TMUS, the RV rating of 1.41 is excellent right now. Moreover, the stock is fully valued at its current price.

- Very Good Safety: in terms of risk, TMUS has very good safety - as validated by the RS rating of 1.29. This rating is derived from a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: The one issue for TMUS right now is the negative price trend that has formed over the last week or so - resulting in a slightly below-average RT rating of 0.94. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating for TMUS is good at 1.21. So - what does that mean for you? Should you buy or sell this stock - or is it time to hold your position right now? Don’t play the guessing game - get a clear answer on your next move by analyzing the stock free today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, TMUS is fully valued with excellent upside potential and very good safety, but the timing is not quite right today.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment