It was an exciting Wednesday trading session for Trade Desk (TTD) investors. The advertising technology company reported earnings for the 4th quarter of 2022 and provided an outlook for the year ahead which sent shares into a frenzy.

The company grew 24% in the 4th quarter despite most of its competitors taking a step backward. Revenue beat analyst estimates narrowly with $491 million compared to $490 million. This was a big step forward from the same period last year when Trade Desk reported just $396 million.

It wasn’t just revenue where Trade Desk shined, either. Net income came in at $71 million for the quarter (14 cents a share), up dramatically compared to the same quarter last year when net income was a mere $8 million (2 cents a share).

But the earnings report itself is only one driving force behind the 35% climb the company’s stock experienced yesterday. It’s also the outlook for the upcoming quarter and the year as a whole. CEO Jeff Green says that 2023 is going to be the year everything in TV advertising changes. Content owners (streaming services) will be able to sell fewer, more relevant ads while the advertisers get better performance.

For the first quarter of 2023, Trade Desk is expecting at least $363 million in revenue while analysts expect just $358 million. The company also expects about $78 million in adjusted earnings compared to the analyst consensus of $75 million. And, to top it all off, management has approved a stock buyback program of $700 million.

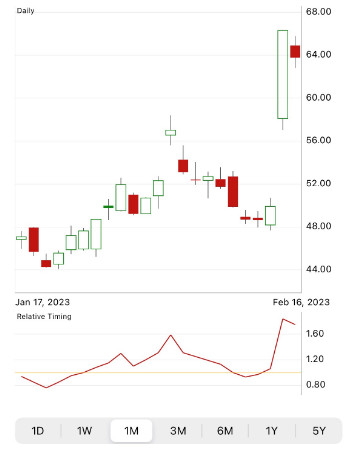

All this considered, it’s no wonder shares exploded yesterday. But in Thursday morning’s trading session, it seems the hype died down and prices started falling back to earth. The stock price is down almost 5% as of 11:30 AM EST.

So – as an investor, is now still a good time to buy? Or, was Wednesday’s trading session lightning in a bottle? There are two things you really need to see before making any decision with TTD. Keep reading for a quick analysis through the VectorVest stock forecasting software.

Despite Excellent Timing, TTD Still Has Very Poor Upside Potential…

The VectorVest system simplifies your approach to finding and assessing opportunities in the stock market. Now, you’re given all the insights you need to make informed, emotionless decisions in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over the average indicate overperformance and vice versa. But the real kicker is that based on these three ratings, VectorVest can give you a clear buy, sell, or hold recommendation. As for TTD, here’s what you need to know:

- Very Poor Upside Potential: In comparing the stock’s long-term price appreciation potential (three years out) to AAA corporate bond rates and risk, VectorVest finds the upside potential to be very poor. The RV rating of 0.45 reflects that. Moreover, the stock is overvalued at its current price. The current value is just $12.70.

- Fair Safety: In terms of risk, TTD is fairly safe – with an RS rating of 0.91, just below the average. This is calculated from the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity

- Excellent Timing: The one thing TTD has going for it right now is hype. Right now, a strong price trend has formed (even despite today’s quick correction) – and the excellent RT rating of 1.73 confirms this. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

These three ratings contribute to an overall VST rating of 1.22 – which is good. But is it necessarily good enough to earn a buy? Does the excellent timing outweigh the very poor upside potential? You can find out by getting a free stock analysis here and getting a clear buy, sell, or hold recommendation.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, TTD has very poor upside potential, fair safety, and excellent timing – creating an interesting situation for investors. But you don’t have to play the guessing game – we can help you find a clear, emotionless answer as to what your next move should be.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment