After several years of dealing with the economic fallout of the pandemic, it looks like some tech stocks may be turning a corner. Airbnb stock skyrocketed 12% Wednesday after exceeding investor expectations during its fourth-quarter report. The company reported higher-than-expected revenue projections and implemented tight cost controls in Q4, leading many analysts to believe that there could be more good news ahead for the company. Airbnb’s median price target was even raised from $115 to $136 based on its bullish forecast for the coming quarters.

Airbnb’s impressive performance comes at a time when the travel industry is still reeling from the effects of the COVID-19 pandemic. Average daily rates have fallen, due to an increase in travel bookings within less expensive urban centers. However, the outlook for travel in the upcoming year is positive, helping investors believe that Airbnb will showcase positive economic performance. With a strong US Dollar and more flexible work arrangements allowing people to explore more locations, domestic and international tourism are likely to pick up soon.

Although there was some belief that post-pandemic travel could remain low, Airbnb’s financial outlook has put an end to these worries. As a result, the company believes that it can achieve 35% margins throughout 2023—the same as last year. After its stock had fallen over 50% in 2022, this recovery is a huge milestone for the company and highlights how its shift in marketing spending strategy is converting travelers. In addition, six of the past eight quarters have seen Airbnb beat investor outlooks.

Investors should view this news positively, as it indicates that the travel industry could be on an upswing. More importantly, it also shows how Airbnb is successfully carving out a larger portion of the market as travelers opt for its more affordable private home-rental options instead of pricey hotels. With layoffs already taking place in 2023 and more expected, rental affordability will undoubtedly continue to be a major factor driving bookings.

Despite the positive news, not everyone is bullish on Airbnb. Some analysts cite the supply of rooms, lofty revenue estimates, and valuation as their top concerns. They worry that too much investment has been made in the company, leading to a stock price that is overvalued with poor upside potential. This could lead to future problems if travel does not pick up as quickly as expected. As such, the most popular rating for Airbnb by institutional investors is held, although Wells Fargo and many other financial players currently rate it a buy.

Overall, it appears that there are plenty of reasons to be optimistic about Airbnb’s future performance—but only time will tell how things shake out in the coming quarters. Factors like the weather in Q4, an increase in rental availability, and the overall economy will all play into Airbnb’s success or failure. When compared to busy travel seasons like what occurred in 2019, it’s clear that Airbnb doesn’t currently have the room supply to cover these types of spikes in demand.

Many property owners and investors who operated Airbnb rentals during busy periods of 2019 have since shifted their focus away from the platform. These operators are now looking at other ways to make money, leaving Airbnb with a smaller supply of rooms when compared to years past. These effects could impact future performance and must be considered by investors before they make any decisions related to Airbnb stock.

While investors may be optimistic about this stock right now, it’s wise to take a step back and look at its fundamentals first. To gain insights about whether ABNB is a smart buy, let’s use VectorVest’s stock forecasting tool. VectorVest evaluates the stock’s health in various aspects, including financial performance, historical data, and growth potential. Its detailed analysis will help you to make informed decisions about investing in Airbnb. With VectorVest on your side, you can be sure that your investment portfolio is well-positioned for success!

Is Now the Time to Invest in Airbnb, or Should Investors Show More Concern for the Travel Industry as a Whole?

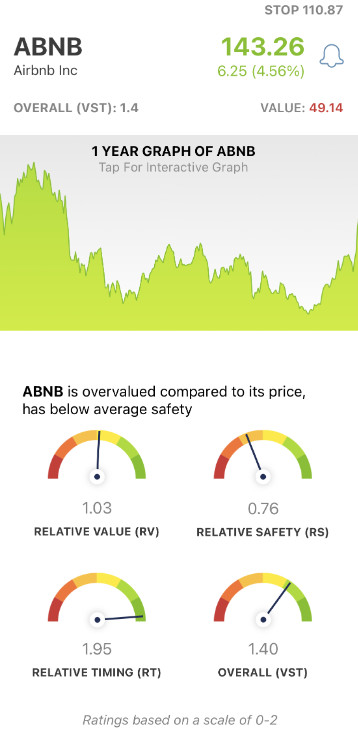

The VectorVest system changes the way you trade for the better. It tells you everything you need to know about a stock in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Gaining insights from these ratings is fast and straightforward, as they sit on a simple scale of 0.00-2.00. Pick stocks with ratings above the average of 1.00 and win more trades!

Making things even easier, the VectorVest system provides you with a clear buy, sell, or hold recommendation based on these ratings. No more guesswork, no more emotion clouding your judgment. As for ABNB, here’s the current situation:

- Fair Upside Potential: According to VectorVest’s analysis, ABNB has an RV of 1.03 on a scale from 0.00 to 2.00, meaning it’s fair on upside potential. While some are bullish about Airbnb’s future financial performance, VectorVest’s analysis believes the stock is overvalued, with a current actual value of $49.14 rather than the current price of $142.67.

- Poor Safety: One big risk for investors is that it’s a highly volatile stock. VectorVest gives it an RS of 0.76, which is poor on a scale from 0.00 to 2.00. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

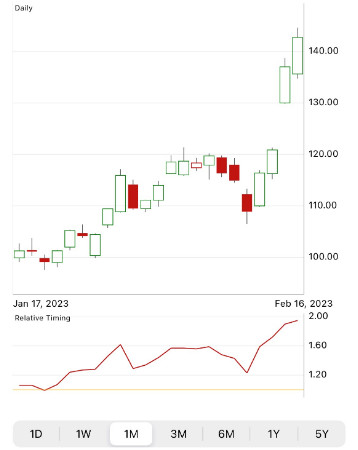

- Excellent Timing: If you’re searching for a stock with exceptional timing, VectorVest’s analysis believes this is the one to beat. It has a Relative Timing of 1.95, which is excellent on a scale from 0.00 to 2.00. This rating is calculated based on the trend’s direction, dynamics, and magnitude. It’s analyzed day over day, week over week, quarter over quarter, and year over year so you have the full viewpoint.

Overall, thanks to its Excellent Timing rating, ABNB has an overall rating of 1.40, which is a positive sign for prospective investors. Does it earn ABNB a buy in the VectorVest system, though? To get a clear answer on your next move with this stock use our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for ABNB, it is overvalued with fair upside potential, poor safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment