KBR, inc. (KBR) started the week strong with exciting news of a deal with NASA. The science, technology, and engineering company has secured a $1.9 billion contract with the government agency to plan, train and fly NASA human spaceflight programs.

While the initial pre-market reaction to this news was positive, we haven’t seen much movement with the stock since the market opened. After climbing more than 3.5% pre-market the stock settled at around a 0.5% gain.

Nevertheless, this is a huge win for the company – which has played a role in aerospace, defense, industrial, and intelligence markets for more than 55 years now. The Houston-based company will empower NASA through mission planning and preparation, Mission Control Center flight controller training, real-time flight execution, and future exploration vehicle design.

Moreover, KBR will build out development services for NASA’s human spaceflight programs. These will be part of the Johnson Space Center (JSC)’s Flight Operations Directorate under NASA. That’s not all, either. KBR is also going to assist in developing software for NASA to use within the ISS Program Avionics and Software Office.

The initial duration of this training contract is five years but can be extended to 9-years through multiple extension options. Work will take place at a number of locations – JSC, Marshall Space Flight Center, and Kennedy Space Center.

This isn’t the first time that KBR and NASA have teamed up to further space exploration. Just last year KBR won a $640 million Ground Systems and Mission Operations-3 (GSMO-3) contract to support a multitude of NASA missions.

While the stock hasn’t really moved on the news, there is still reason for investors to be excited. But, if you aren’t currently invested in KBR, is this your sign to buy? We’ve put this stock under a microscope through the VectorVest stock analyzer and have 3 things to show you that will help you decide what to do – one way or the other.

KBR Has Good Upside Potential, Fair Safety, and Very Good Timing

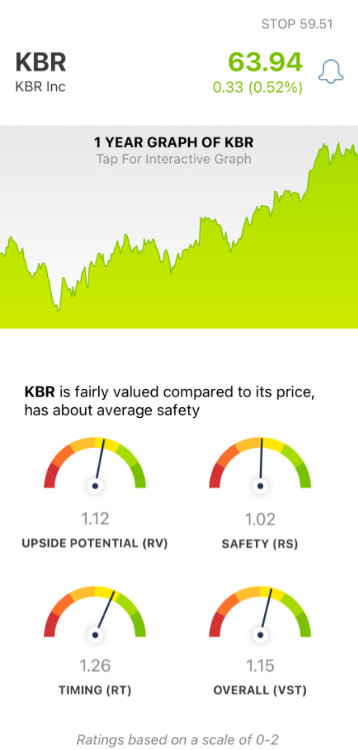

The VectorVest system simplifies your trading strategy by giving you all the information you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a scale of 0.00-2.00, with 1.00 being the average.

But, it gets even better. Because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation - at any given time. That being said, here’s what we’ve unearthed in looking at KBR:

- Good Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (projected 3 years out) and AAA corporate bond rates & risk. As for KBR, the RV rating of 1.12 is good. What’s more, the stock is fairly valued at its current price of $63.94.

- Fair Safety: In terms of risk, KBR is a fairly safe stock - with an RS rating just above the average at 1.02. This rating is calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: Despite a lackluster response on this NASA deal, KBR has still rallied more than 12% in the past 3 months and nearly 28% in the last year. That being said, the stock has very good timing - as evidenced by the RT rating of 1.26. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.15 is considered good for KBR - but is it enough to win the stock a spot in your portfolio? Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move through a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After securing a massive $1.9b contract with NASA, KBR has good upside potential, fair safety, and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment