Kohls (KSS) welcomed a new company leader in February – Thomas Kingsbury. Apparently, the new CEO already likes what he sees at the helm. He (along with other company executives) recently acquired large chunks of company stock.

The specific details of Kingsbury’s purchases come out to a total of 229,000 shares. Yesterday alone, though, he added 92,500 shares to his portfolio – a value of right around $2 million.

This sent ripples through the stock market, and has helped steer the price of this particular stock in the right direction. It was up as much as 9% on March 29 (Thursday) when the SEC filing came through about Kingsbury’s move. And that momentum has carried through into Friday’s trading session, as the stock has climbed another 3% so far.

What a welcome sign this is for investors, who have weathered a brutal last few years. The company lost 61% of its market value in the last year alone. Last quarter Kohls reported a net loss of $273 million after sales dropped over 7%.

However, it appears as if things are poised to turn around. Despite the fact that the environment is only going to worsen, the company is expecting net sales to decrease by just 2-4%. Moreover, diluted earnings per share are expected to rise up from the abysmal -$0.15 it saw in 2022 to as high as $2.70.

Now, in saying all this, it’s not unusual for executives to purchase stock in their own company – especially an incoming CEO trying to start his new journey on the right foot. Nevertheless, you may be wondering if you should follow suit and buy KSS stock yourself. So, take a look below at 3 key findings through the VectorVest stock analyzing software before you make your next move.

Despite Good Upside Potential, KSS Still Has Poor Safety & Timing

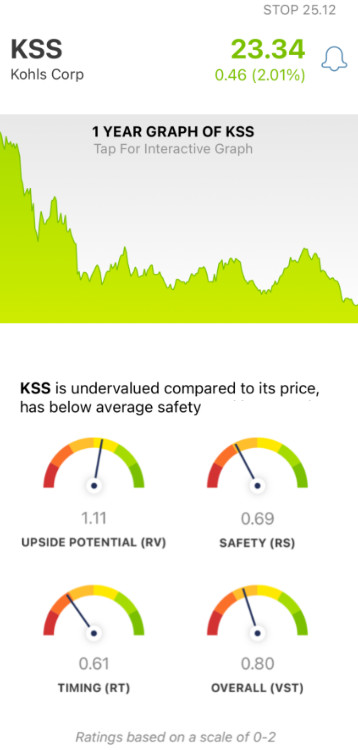

Wouldn’t it be nice to win more trades with less work? That’s exactly what the VectorVest system helps you accomplish. You’re given all the information you need to make confident decisions in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is quick and easy as each one sits on its own scale of 0.00-2.00, with 1.00 being the average. And based on these 3 ratings, VectorVest issues a clear buy, sell, or hold recommendation for any given stock, at any given time. As for KSS, here’s the current breakdown:

- Good Upside Potential: The one thing KSS has going for it right now is how cheap it is - meaning there’s room for growth. The RV rating of 1.11 is good, and is calculated based on the stock’s 3-year price appreciation projection alongside AAA corporate bond rates and risk. Moreover, the stock is undervalued as it sits today. The current value is $29.36/share.

- Poor Safety: In terms of risk, though, KSS has poor safety - as evidenced by the RS rating of 0.69. This rating is derived by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: Despite the last few days of positive price movement, the RT rating of 0.61 is still poor. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating of 0.80 is poor. So, does that mean it’s time to sell off your position if you’re still invested in this stock? Or, should you keep holding - as the last few days could be a sign of what’s to come in 2023?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis today before it’s too late!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for KSS, it does have good upside potential - but the safety and timing are still poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment