Lyft stock got a downgrade after reporting third-quarter earnings – despite an impressive, record-breaking performance. The stock hasn’t moved too much as a result of all this news. Nevertheless, investors are wondering if the time is up for the ridesharing company – or if there is still reason to hold onto hope. We’ve got the answer you’ve been searching for down below.

Before we get into analyzing Lyft stock through the VectorVest system, let’s talk about what happened. The company reported revenue growth of 22% year over year – coming in at $1.05 billion. This was just shy of analyst predictions of $1.051 billion.

Meanwhile, the company was able to cut costs in the third quarter – with an adjusted net income of $36.7 million. This was more than double the net income in 2021 of just $17.8 million. However, the company did report a net loss of $422.2 million.

One issue that has analysts and investors concerned is the slowing active rider growth. This isn’t a new issue. Since the COVID-19 pandemic ridesharing companies have taken a serious hit. However, as life returns to normal, companies like Lyft (and Uber) are struggling to regain their footing. This is coupled with other forces like rising fuel costs and a looming recession which has slowed down travel as a whole.

While Uber faces many of these same challenges, they appear to be pulling further and further away from Lyft in comparing both companies’ third-quarter earnings reports. But, looking ahead to the 4th quarter, Lyft is looking for revenue growth and stronger profitability. One way in which they will do this is by laying off about 13% of their workforce.

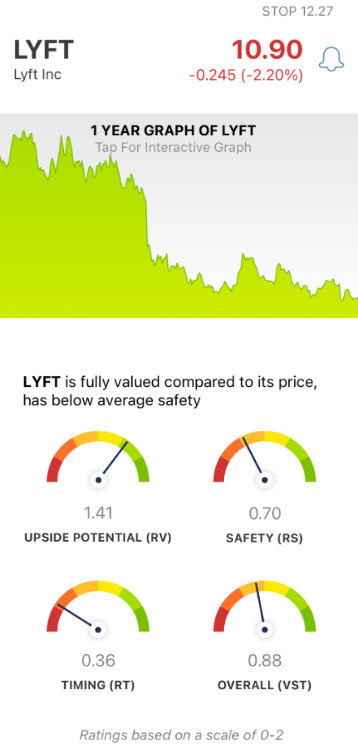

Will this be enough, though? Looking at the last year for Lyft stock, the company is down almost 75%. Nevertheless, investors who have maintained their position are still holding onto any semblance of hope that this company can turn things around. But is it finally time to cut losses as the stock sits at the lowest point in its publicly traded history of just $10.90/share?

To get a clear answer on what your next move should be, read down below. We’ve identified three things you need to know about Lyft from the VectorVest stock forecasting software.

Lyft Has Excellent Upside Potential Despite Poor Safety & Very Poor Timing…

The VectorVest system transforms the way you identify and vet opportunities in the stock market. Now, you can gain effortless insights into the most pertinent information on any given stock, at any given time. All you need is three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 making interpretation easy and quick.

The best part is that based on these three ratings, VectorVest provides you with a clear buy, sell, or hold recommendation. So, what’s going on with Lyft through the VectorVest lens?

- Excellent Upside Potential: The RV rating takes a look at the long-term price appreciation potential three years out. As for LYFT stock, VectorVest finds excellent upside potential – and the RV rating of 1.41 reflects that. It’s also worth noting that VectorVest deems LYFT stock to be fully valued at the current price point.

- Poor Safety: As an indicator of risk, relative safety analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for LYFT, the current RS rating of 0.70 is poor.

- Very Poor Timing: As far as timing is concerned, LYFT is struggling. The RT rating analyzes a stock’s price trend day over day, week over week, quarter over quarter, and year over year. It takes into account the direction, dynamics, and magnitude of that trend. As for LYFT, the RT rating of 0.37 is very poor – and this is reflected in the company’s 1-year stock chart.

All of this works out to an overall VST rating of 0.88 – which is fair, but below the average of 1.00. So – is it finally time to cut losses? Or should you keep holding your position? To get a clear buy, sell, or hold recommendation for LYFT, analyze the stock free here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for LYFT, it is fully valued with excellent upside potential, poor safety, and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment