Roku stock has had a rough year on the stock market, sitting 76% lower than this time last year. And, it appears things could be getting worse as one analyst who has been high on Roku stock finally downgraded the company.

This sent shares 5% lower early Tuesday morning during pre-market trading, but they quickly recovered. However, we’ve identified 3 red flags that investors need to take heed of before their next move with Roku. Before we unveil our findings, we’re going to discuss KeyBanc analyst Justin Patterson’s concern with the company.

While he did not provide a new price target on Roku, Patterson did change his rating from Overweight to Sector Weight. The main reasons for this were profitability and 2023/2024 outlooks. Roku is slowly but surely falling behind its peers in terms of market share – while maintaining high debt in its tech ad stack. This is a recipe for disaster.

Roku has concerns of its own as well – as the company expects to take a step backward during the 4th quarter of 2022. During the 3rd quarter earnings release, executives projected a 7.5% drop in revenue year over year. This resulted in a strengthening of the negative price trend Roku has shown for the past year and counting.

It’s worth noting that Roku is working to address these concerns – laying off 200 workers as a start. However, to adequately address the issues of debt would require additional investment – something Roku cannot afford at this time. As a result, experts are expecting a loss for Roku of $79 million in the coming years.

Patterson isn’t alone in his concerns. In fact, he is the fifth analyst to downgrade Roku stock in the last month. But, these ratings don’t paint you the full picture of what’s going on with a stock. They may even leave you with more questions than answers.

Does this downgrade mean it’s time to sell the stock? Or, does the fact that it quickly recovered from the news indicate there is still reason to hold on? After all, Roku stock is now trading almost 2% higher than it was yesterday prior to this downgrade.

Below, we’ll unveil the three major problems ROKU has right now. We were able to easily uncover these through the VectorVest stock analysis software – here’s what you need to know…

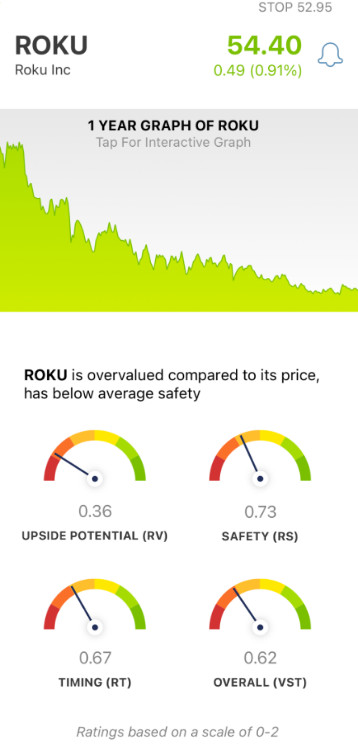

Roku Has Very Poor Upside Potential with Poor Safety & Timing

The VectorVest system is a game changer for investors who want quick, accurate stock insights at their fingertips. You can learn everything you need to know to make emotionless decisions from just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings are easy to understand as they sit on a simple scale of 0.00-2.00 – with 1.00 being the average. Anything over the average is over performing and vice versa.

But the best part is that the culmination of these three ratings leads to an overall VST rating for the stock. And from that, VectorVest is able to provide investors with a clear buy, sell, or hold recommendation – for any given stock, at any given time. As for Roku, here’s the current situation:

- Very Poor Upside Potential: Taking a look at the long-term price appreciation potential three years out, VectorVest confirms what analysts are seeing – and gives a very poor RV rating of just 0.36. Moreover, the stock is currently overvalued at a share price of $54.40 – with a current value of just $17.27.

- Poor Safety: An indicator of risk, the RS rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for Roku, the RS rating of 0.73 is poor.

- Poor Timing: Finally, the RT rating of 0.67 is poor for Roku as well. This rating analyzes the direction, dynamics, and magnitude of a stock’s price trend. It’s calculated based on trends day over day, week over week, quarter over quarter, and year over year.

These three ratings work out to an overall VST rating of 0.62, which is poor. But does that mean it’s time to sell – or should you keep holding to see what happens as the noise from this downgrade dies down? You don’t have to play the guessing game or let emotion influence your decision-making – get a clear buy, sell, or hold recommendation through a free stock analysis at VectorVest.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for ROKU, it is overvalued with very poor upside potential, poor safety, and poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment