Two investment firms teamed up to submit a proposal to purchase Macy’s (M) back in December. After mulling over the offer for a few weeks, the retailer announced today that it would not be accepting the $5.8 billion bid brought forth.

Arkhouse Management and partner Brigade Capital Management were eager to take the department store retailer private. The company was once an industry leader but has struggled to keep up amidst a changing of the guard as younger companies steal the spotlight. The shift away from physical shopping in favor of online retailers has presented a challenge as well.

Arkhouse and Brigade are already heavily invested in M, and their proposal put the company at a valuation of $21/share – it sits at just $18/share today after gaining a few percentage points on this news.

However, it appears the hype around a potential sale is kaput – for now, at least. The would-be-buyer’s were asking for due diligence and teased that the original offer could be raised even higher if this access was granted.

Macy’s responded that the offer wasn’t high enough or credible enough to warrant such access in the first place. The board released a statement questioning the two investment firms’ ability to finance this transaction and were unsatisfied with the valuation given their impressive real estate portfolio.

The company is willing to listen to other offers, but the bidder will need to show not only committed financing but also a history of successfully acquiring retail companies already.

Arkhouse Management already responded claiming their financier – Jeffries Investment Bank – pieced together a letter supporting the offer’s validity.

What really makes Macy’s an attractive acquisition is its real estate portfolio, which is said to be valued as high as $11.6 billion. Although the commercial real estate segment is suffering, Macy’s owns historic, sought-after buildings around the country.

When we first wrote about Macy’s receiving the offer from these firms, the stock skyrocketed 86%. It’s fallen a bit since then, but don’t let that deter you. We’ve taken a look through the VectorVest stock forecasting software and found a compelling reason to consider buying M.

M May Have Poor Upside Potential and Safety, But its Timing is Excellent

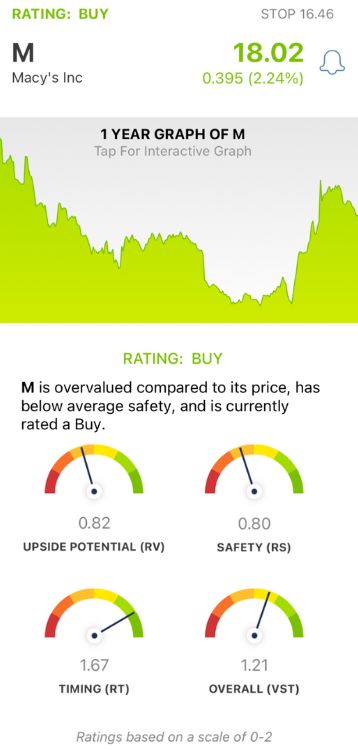

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - all in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it gets even easier.

The system offers a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we see for M right now:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. This offers much better insight than a simple comparison of price to value alone. M has a poor RV rating of 0.82 right now.

- Poor Safety: The RS rating is a risk indicator calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.80 is poor for M.

- Excellent Timing: This is where things get interesting, as M has an excellent RT rating of 1.67. Since news of this offer broke the stock has climbed higher before setting around $18-20/share, up from just $10/share two months ago. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.21 is good for M and enough to earn the stock a BUY recommendation right now. But, we do encourage you to learn more through a free stock analysis before you do anything else. Transform the way you trade for the better today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. M climbed a bit today after announcing it would turn down the $5.8b bid from Arkhouse and Brigade, citing a lack of financial validity and a low valuation. The stock has poor upside potential and safety, but its timing is excellent right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment