Meta – the Facebook & Instagram parent company – waited until after trading hours yesterday to release their earnings report for Q4 of 2022. And it caused a frenzy in this morning’s trading session as the stock soared nearly 25% by 11:30 AM EST. What caused the hype, though?

The company beat expectations on Q4 revenue, coming in at $32.17 billion – ahead of the analyst estimate of $31.65 billion. This revenue is primarily attributed to the advertising platform, which outperformed what everyone was expecting in an increasingly competitive environment. Moreover, Meta grew its platform users with Facebook daily users of 2 billion vs an expected 1.98 billion.

Seeing the stock market’s reaction to this earnings report you’d think it was all good news – but that is definitely not the case. Earnings per share fell short of expectations at $1.76 compared to the $2.26 estimate. And the company reported a steep loss on their augmented reality segment “Reality Labs”. This was somewhat expected, and analysts were looking to see a loss of just under $4 billion. But the actual loss came in higher at $4.28 billion.

Well, another reason for the jump in share prices can be attributed to Meta’s cost-cutting measures. They were able to lower the full-year expense projection for 2023. Now, they’re expecting $89-95 billion compared to the previous outlook of $94-100 billion.

And that’s not all. Meta also took things a step further announcing a stock buyback plan of $40 billion. All of this has contributed to the fact that META stock is on track for its best day of growth in nearly 10 years. The stock price hasn’t reached this height since June of last year.

Last time we wrote about META, it was time to sell. Has that recommendation changed as a result of all this? Is it time to buy META now? Get a clear answer on what you should do with this stock by reading below – we’ve got three things you need to see in the VectorVest stock analyzer software.

Despite Very Poor Upside Potential, META is Very Safe and Has Excellent Timing

The VectorVest system will simplify your trading strategy and save you time & stress. It tells you everything you need to know to make accurate, informed decisions with just three ratings: relative value (RV), relative safety (RS), and relative timing (RT).

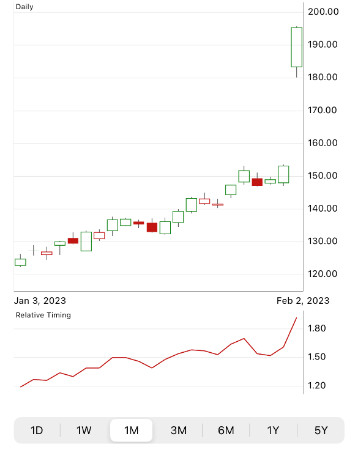

Together, these sit on an easy-to-understand scale of 0.00-2.00 – with 1.00 being the average. By picking stocks with ratings over the average, you can win more trades – it’s that easy. Better yet, you can follow the clear buy, sell, or hold recommendation VectorVest offers for any given stock, at any given time based on these ratings. As for META, here’s what’s happening right now in real-time:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (3 years out) with AAA corporate bond rates and risk. As for META, the RV rating of 0.41 is very poor. And, the stock is way overvalued at the current price. Its current value is just $65.36/share.

- Very Good Safety: An indicator of risk, the RS rating assesses a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. Right now, the RS rating of 1.25 is very good for META.

- Excellent Timing: As you can see based on the near vertical spike in stock price today, the timing for META is excellent – as confirmed by the RT rating of 1.90. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating for META is very good at 1.39. Does that mean it’s time to buy the stock right now? Don’t miss the opportunity to get in at the perfect time – get a clear recommendation on your next move with a free stock analysis now!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, META is overvalued with very poor upside potential. However, the stock has very good safety and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment