Snapchat (SNAP) reported their 4th quarter earnings for 2022 yesterday, and once again came in under expectations. It appears the rumors of growing headwinds we discussed back in December of last year are proving to be true.

SNAP reported an EPS of 14 cents which outperformed the expectation of 11 cents – but the company fell short in virtually all other KPIs. Revenue, global daily active users, and average revenue per user all missed analyst expectations.

While revenue was up slightly from the same period last year, the company referred back to growing economic headwinds, platform policy changes, and increased competition as causes for the underperformance.

Snapchat decided against providing guidance for the upcoming period or the year as a whole, however, it’s been said they are expecting a decline of 2%-10%. This goes against what analysts were hoping for from SNAP – a slight increase in revenue.

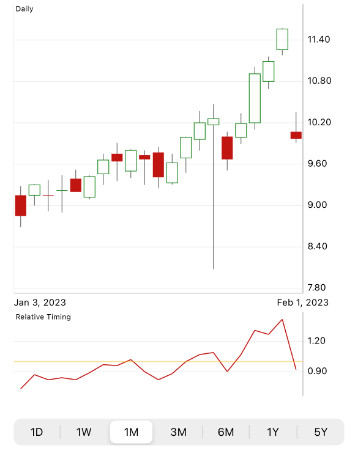

In January, SNAP had managed to rally an 8% gain – before losing it all and then some as a result of today’s news. The stock is trading 14% lower as of 11 AM EST. This begs the question – is it time to cut losses as an investor? Or, is there some reason to still hold onto hope? We’ve taken a look at SNAP through the VectorVest stock analyzer system and have three things you need to see below:

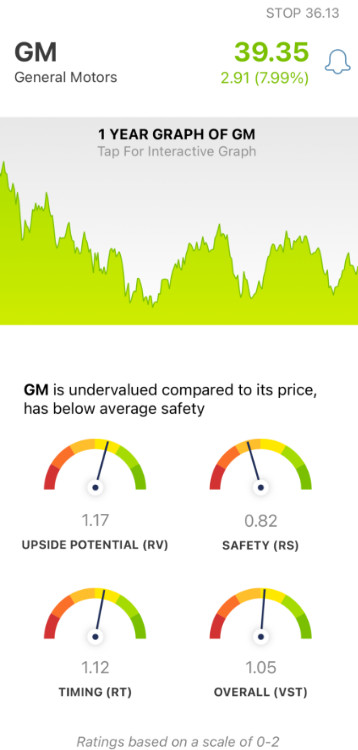

SNAP Has Very Poor Upside Potential, Poor Safety, and Fair Timing

The VectorVest system changes the way investors uncover and analyze opportunities in the stock market. It can tell you what to buy, when to buy it, and when to sell it – helping you make more informed decisions with less work. And, it’s all based on three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over the average indicate good performance and vice versa. The best part, though, is that based on the overall VST rating for a stock, VectorVest can give you a clear buy, sell, or hold recommendation – at any given time. No more guesswork or emotion influencing your decision-making. As for SNAP, here’s the current situation:

- Very Poor Upside Potential: In looking at SNAP’s long-term price appreciation potential compared to AAA bond rates and risk, VectorVest has provided a very poor RV rating of 0.19. Moreover, the stock is overvalued even after today’s steep dropoff. The current value for SNAP is an abysmal $1.56.

- Poor Safety: An indicator of risk, relative safety looks at a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. And right now, SNAP has a poor RS rating of 0.59.

- Fair Timing: SNAP had a positive price trend forming up until yesterday, which has been wiped out by this news. Now, the RT rating of 0.94 is just below the average – but fair nonetheless. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to help you assess the full picture.

In taking these three ratings and averaging them out, the overall VST rating for SNAP is poor at 0.68. So – is it officially time to sell your position and cut losses? Or, should you keep waiting a bit longer? You don’t have to wonder any longer – get a free stock analysis here and make your next move with confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, SNAP is way overvalued with very poor upside potential, poor safety, and fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment