Last year GM reported record-breaking full-year revenues of $10.4 billion. This year, the company did it again – outshining last year’s performance with a full-year adjusted income of $11 billion.

The company also reported profits in excess of what analysts were expecting for the fourth quarter. Moreover, earnings per share were up to $2.12 from $1.35 in the same period last year. This figure was also an overperformance from what analysts anticipated – just $1.69/share.

With all this said, GM CFO Paul Jacobson expects 2023 to be a step back from 2022’s performance – with income falling somewhere between $8.7b to $10.1b. The automotive segment will continue to shine, but GM Financial will suffer from rising interest rates, falling used car values, and an overall worsening economy.

However, the earnings report was also accompanied by a declaration of intent to invest heavily in the production of lithium for GM’s EV lineup. The company announced a $650 million stake to be made in Lithium Americas. This play will give the company access to the raw material necessary to supply 1 million electric vehicles for this upcoming year of production.

The last time we wrote about GM, the company was rated a “buy” after restoring a quarterly dividend for shareholders. Does that recommendation still hold true today after all this news? The stock is up 8% in Tuesday trading so far. Keep reading to find out what your next move should be with this stock – we’ll take a look through the VectorVest stock forecasting software.

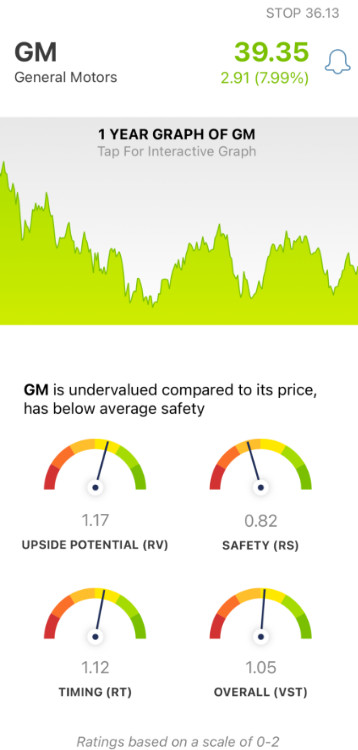

While GM Has Good Upside Potential and Timing, its Safety is Poor

The VectorVest system allows you to effortlessly uncover and analyze opportunities in the stock market, eliminating guesswork and emotion from your strategy. You’re given all the information you need to make informed decisions through three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over the average indicate good performance and vice versa. And based on these ratings, you’re given a clear buy, sell, or hold recommendation for any given stock, at any given time – including GM. Here’s the current situation:

- Good Upside Potential: The RV rating analyzes a stock’s long-term price appreciation potential in comparison to AAA corporate bond rates and risk. Right now, the RV rating of 1.17 is good for GM. Moreover, the stock is undervalued at its current price, with a current value of $46.48.

- Poor Safety: In terms of risk, GM has poor safety with an RS rating of 0.82. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Good Timing: Over the past month, investors have seen a positive price trend has been forming for GM – and the good RT rating of 1.12 confirms that belief. This rating is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.05 is just fair for GM. So, what does that mean for investors? Is it still worth buying this stock, or should you wait for a stronger price trend to form? You don’t want to miss this opportunity – get a clear answer on your next move through a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, GM is undervalued with good upside potential and timing – but the stock has poor safety right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment