Michael Burry made a name for himself profiting from the subprime mortgage crisis. Because of what he managed to do, many investors still track his trades and follow his moves themselves. And recently, Burry added 7 new positions to his portfolio at Scion Asset Management as he believes an economic downturn is all but guaranteed in 2023.

We’ve already unpacked the first 6 companies he invested in – JD, BKI, COHR, WWW, BABA, and MGM. Today, we’re wrapping up this series by analyzing SkyWest to help you determine if you should follow in Burry’s footsteps and add this stock to your own portfolio. He picked up 125,000 shares of this North American regional airline, which works out to roughly 4% of his portfolio.

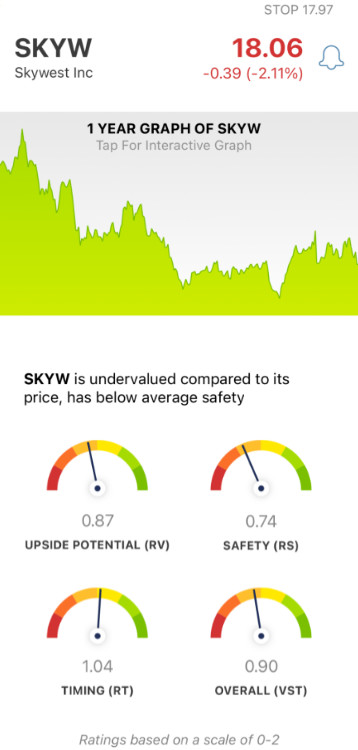

2023 started strong for SkyWest, as the company flew to nearly $22/share by mid-January – a nearly 26% gain in just a few short weeks. Since then, though, the stock has slowly but surely leveled out. And in the more near term, it’s actually been heading in the wrong direction. We’ve witnessed shares drop 7% in the last month and 5% in the last week.

Part of this can be attributed to the fact that SkyWest is changing the way it bills larger airline patterns – which resulted in a surprise to investors on a recent earnings call. And more recently, the company has been making rounds in the tabloids after 2 flight attendants got into an altercation prior to takeoff – leaving travelers stranded on the runway for hours.

Nevertheless, seasoned investors like Burry see value in this company. And he’s not alone. Quadrature Capital Ltd. recently announced a new stake in SkyWest, acquiring 66,000 shares. Other hedge funds have bought into SkyWest recently too, including Marshal Wave LLP (71,689 shares), Federated Hermes Inc. (426,424 shares), and First Trust Advisors LP (181,384 shares).

So, with that being said, should you follow suit and buy SKYW yourself? You don’t have to play the guessing game or let emotion influence your decision-making. We’ll help you uncover a clear answer on your next move through the VectorVest stock analyzing software below:

Despite Poor Safety, SKYW Has Fair Upside Potential and Timing

The VectorVest system helps you simplify your trading strategy to win more trades with less work. It’s possible thanks to our proprietary stock rating system - which has outperformed the S&P 500 by 10x for more than 20 years!

You’re given all the insights you need to make confident, calculated trades with just three ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00, with 1.00 being the average. And based on the overall VST rating, VectorVest gives you a clear buy, sell, or hold recommendation. As for SKYW, here’s the current situation:

- Fair Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. And right now, the RV rating of 0.87 is below the average - but fair nonetheless. What’s more, the stock is undervalued right now - its current value is $20.61/share.

- Poor Safety: The biggest issue for SKYW right now is risk, as indicated by the poor RS rating of 0.74. This is calculated from the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity

- Fair Timing: In terms of the stock’s price trend, SKYW has fair timing right now - with an RT rating just above the average at 1.04. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for SKYW is 0.90 - which is below the average but still considered fair. So, should you add this company to your portfolio as well? Or, should you wait for a more meaningful price trend to form before making a decision one way or the other? Get a clear answer on your next move with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, SKYW has fair upside potential and timing - but the safety of this stock is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment