Shares of Moderna (MRNA) climbed 13% in yesterday’s trading session after being upgraded to a buy at Oppenheimer. The stock fell a bit in Wednesday’s trading session, but has since settled at around even on the day.

Hartaj Singh and a team of analysts see dramatic upside potential over the next few years for Moderna, leading to an upgrade from “perform” to “outperform”. And outperform is exactly what the stock did yesterday, leading the entire S&P 500 index on this news.

Singh and other Oppenheimer analysts say that the biotech company could have up to 5 new products approved over the next 2 years. This is exactly what investors needed to hear as Moderna’s COVID-19 vaccine has already peaked and sales continue to dwindle lower and lower.

Some of the most promising products in the works include vaccines for flu and RSV. These are the more medium-term products that may gain approval in the next 12-18 months. After that will come clinical and regulatory catalysts for INT and CMV. A cancer vaccine specifically designed for melanoma patients is also being developed.

While Oppenheimer is excited about Moderna, Singh was transparent in saying that sales have likely not reached their bottom just yet. 2024 will see revenue fall even lower for the company before starting to climb back up in 2025.

To make up for this, Moderna is investing in education on awareness of the need for boosters. It also lowered its operating expenses heading into 2024 and through 2025.

The $142 price target Singh and his team put on MRNA implies a 30% upside. That being said, we’ve taken a look at the stock ourselves through the VectorVest stock forecasting software. Here’s why we don’t think it’s time to buy this stock just yet…

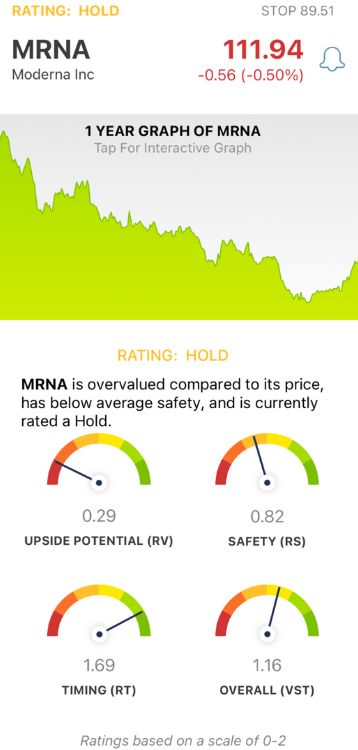

Despite Excellent Timing, MRNA Has Very Poor Upside Potential With Poor Safety

VectorVest simplifies your trading strategy to empower you to win more trades with less work and stress. It’s a proprietary stock rating system comprised of 3 easy-to-use ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. You’re even offered a buy, sell, or hold recommendation for a stock based on its overall VST rating at any given time. As for MRNA, here’s what we’ve uncovered:

- Very Poor Upside Potential: While Oppenheimer sees 30% upside potential over the next 12-18 months for this stock, VectorVest does not. The RV rating assesses a stock’s long-term price appreciation potential (forecasted 3 years out) compared to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. The RV rating of 0.29 is very poor for MRNA.

- Poor Safety: The RS rating is a risk indicator derived from a deep analysis of a company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.82 is poor for MRNA.

- Excellent Timing: The one thing this stock has going for it is a strong positive price trend, bolstered by the upgraded rating yesterday. The RT rating of 1.69 is excellent. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.16 is good for MRNA, but not enough to earn a buy recommendation. The stock is currently rated a HOLD in the VectorVest system. But, you can learn more and derive your own conclusion through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. MRNA gained 13% yesterday after being upgraded to outperform at Oppenheimer, as analysts see a 30% upside in this stock over the next 12-18 months. While VectorVest does recognize the stock’s excellent timing, it still has poor safety and very poor upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment