Sticks and stones may break my bones, while an analyst’s rating will move a company, as can be witnessed by Verizon Communication’s (VZ) 2% uptick following Keybanc’s upgrade. Verizon made initial gains at the start of the year after Keybanc upgraded the company to ‘overweight,’ with a bright outlook for the fiscal year of 2024. An upgrade like this is a significant indicator for a telecommunication company that is dependent on consistency, so let’s look into why things are shifting.

Why did Keybanc upgrade Verizon to ‘overweight’? Analysts at Keybanc are a bit bullish with expectations for Verizon’s EBITDA growth to rise above 2% compared to being flat the year prior. The growth would be significant for the company, paired with the stock trading at notably low levels, which explains why analysts expect a strong performance in the future. The rating is what launched Verizon upwards in the market, but there’s more to consider before investing in VZ.

On top of Keybanc’s rating (which is also based on the following information), Verizon is also riding high after reporting the first positive annual performance in 5 years, along with continued subscriber growth for postpaid phones. The company also cut capital expenditures and is focusing on overall decreased spending. It sounds like positive news with increased subscribers, on top of more positive news with cutting spending, leading VZ to have a great year. In fact, even AT&T and T-Mobile experienced mild gains piggybacking off of the surge in the industry.

If you’re a long-term investor, a rate upgrade is one of many factors that you look at before investing. VectorVest uses software to examine multiple ratios and factors, and it can analyze Verizon for all of these components with a future projection. The software uses these data points and financial metrics to determine if VZ is worth the investment.

Verizon’s Timing Means It’s Time to Invest

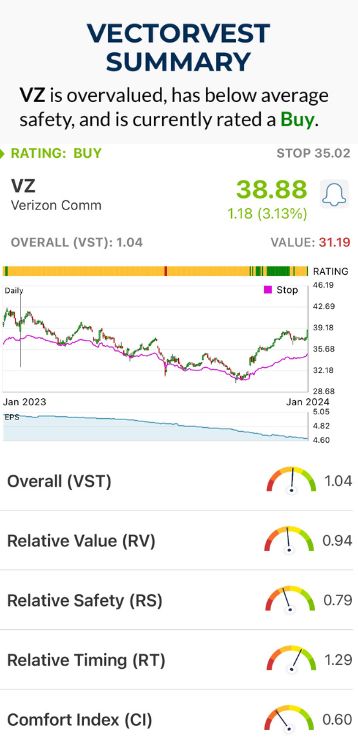

VectorVest software generates three summary ratings: relative value (RV), relative safety (RS), and relative timing (RT), each scored from 0.00 to 2.00, with 1.00 representing the average; then the overall VST (Value-Safety-Timing) rating provides a decisive buy, sell, or hold suggestion for a specific stock. VectorVest’s three summary and overall ratings evaluated VZ and concluded with a BUY recommendation.

- Fair Upside Potential: The Relative Value score for VZ is 0.94, making it slightly below average on a scale of 0.00 to 2.00. It is overvalued, with a current price of $38.88 but a value of $31.19 because of the climate of competitors and the line of business.

- Poor Safety: VZ has a Relative Safety score of 0.79, which is below average on a scale of 0.00 to 2.00, so despite the positive outlook, there is still minor unpredictability for the company's potential despite Keybanc’s rating.

- Very Good Relative Timing: The relative timing of VZ is 1.29, rated as very good on a scale of 0.00 to 2.00. The metric considers the stock movements daily, weekly, quarterly, and yearly, so even with the poor safety, Verizon is showing quite a bit of positive growth, and the year's timing is calculated as a good opportunity.

The overall VST rating of VZ is 1.04, which is considered above average and followed by a BUY recommendation in the VectorVest system. BUY indicates that if you own the stock, you should keep it in your portfolio and consider getting more, and if you’re not already invested, buy-in.

Although there’s a rating of poor safety for VZ, VectorVest software evaluated more than just one component. The trajectory and risks associated are made clear with the company through the Poor Safety and Very Good Timing. Considering the timing and potential for gains, it concluded that the stock was worth the BUY recommendation. You can learn more about how the system works or the current opportunity with any given stock through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying stocks with proper analysis, not just the market’s movements for that day. Verizon Communications is positively pushing telecommunication companies on the market, and VectorVest helped visualize the value behind VZ as a single stock. The stock has fair upside potential, poor safety, and very good relative timing, with a recommendation to BUY. Allowing you to see all the necessary components, along with a summarized conclusion, to make an informed decision.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment