Yesterday morning Reed Hastings – CEO of Netflix – went on the record to state that the company dropped the ball with its ad strategy. In fact, he states that Netflix should have launched its ad-supported tier years ago.

In his interview with the New York Times, Hastings admitted he looked at advertising through the wrong lens for years. While competitors like Hulu saw incredible success at scale with an ad-supported tier, Hastings and the rest of the Netflix team were late to the party. Why? They were focused on the wrong advertising channels – Google and Facebook.

Because Hastings was on the board at Facebook, he wholeheartedly believed that these digital marketing channels would be a better option for advertisers – and that serving TV ads was a thing of the past. That’s obviously proven to be false, though. In fact, Netflix sat on the sidelines and watched all its competitors thrive with ad-supported tiers. Not just Hulu, but HBO Max, Peacock, Paramount+, Disney+, and more.

While Hastings has admitted that he himself dropped the ball in this sense, he also claims the company will catch up. But how confidently can he say that when the company sits over 50% lower than it did this time last year? In the past 3 months, Netflix stock has made an impressive rally back in the right direction, but will this trend persist?

It is worth noting that VectorVest saw the Netflix drop coming – and issued a sell warning long before the stock fell 60%. And, our users were first to the party when conditions shifted and Netflix became a buy again upon news of their ad-supported tier.

If you’re an investor wondering what the future holds for Netflix now that they’ve gone all in on an ad-supported tier, you’re in luck. The VectorVest stock forecasting software can help you make your next move with confidence. In fact, we’ve identified a major issue with NFLX stock through the system – keep reading to learn more…

NFLX Has Poor Upside Potential But Very Good Timing…Is There an Opportunity for Traders Right Now?

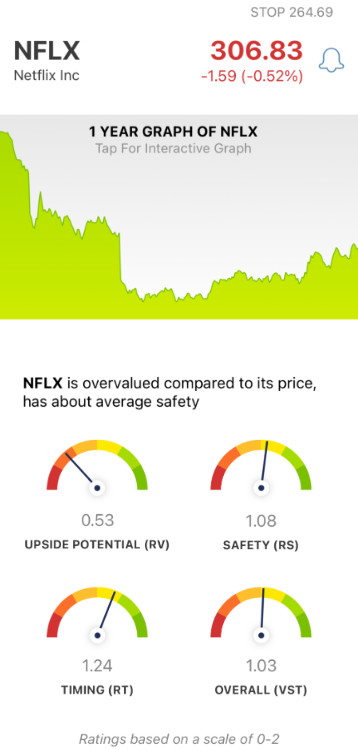

The VectorVest system simplifies trading by telling you everything you need to know in just three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 – with 1.00 being the average.

Ratings over the average indicate overperformance and vice versa. And based on the overall VST rating of a stock, the system provides you with a clear buy, sell, or hold recommendation – no guesswork necessary. Here is the current situation with Netflix:

- Poor Upside Potential: the RV rating analyzes a stock’s long-term price appreciation potential up to three years out. As for NFLX, the RV rating of 0.53 is poor. This is coupled with the fact that the stock is still overvalued at the current price of $306.83 – with a current value of just $98.65.

- Fair Safety: an indicator of risk, RS analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for NFLX, the RS rating of 1.08 is fair.

- Very Good Timing: taking a look at the price trend for NFLX, VectorVest deems the timing to be very good – with an RT rating of 1.24. This is based on the direction, dynamics, and magnitude of the price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for NFLX is just fair at 1.03 – so should you hold on for a stronger price trend? Or is now the time to buy? Get a clear answer through our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for NFLX, it is overvalued with poor upside potential but has fair safety and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment