Everyone’s favorite canned soup brand got a nice bump Wednesday morning after reporting impressive earnings that beat analyst expectations. Furthermore, the company rose its outlook for the full fiscal year of 2023. Investors are flocking to this stock as the timing is right. But – with upside potential and safety leaving much to be desired, we’re still not sold on this stock quite yet.

In looking at the earnings report, Campbells (CPB) beat EPS estimates of $0.86 with an actual reported EPS of $1.02. Furthermore, they beat revenue estimates of $2.42B with reported revenue of $2.58B. And, executives at the company claim these figures would have been even stronger in more favorable circumstances.

CEO Mark Clouse attributed the brand’s success in the fiscal first quarter to a few things. First and foremost, the company improved execution across the supply chain and implemented inflation-driven pricing actions to keep up with unfavorable economic headwinds. Productivity within the company has improved, too.

As a result of the impressive first quarter, executives at Campbell have raised guidance for the full fiscal year of 2023 from a previous expectation of $2.85 to $2.95 to $2.90 and $3 per share. Moreover, they expect net sales to grow anywhere from 7-9%.

CPB stock is among the few that have risen in value over the past year. The stock is up 35% in the last 365-day period and has seen an impressive rally in the past 3 months. This trend was certainly strengthened after today’s news.

But – does that mean it’s time to buy CPB stock? If you’re looking for a clear answer on what your next move with this stock should be, read on below as we explore three key insights investors need to see in regard to CPB.

The Timing is Right for CPB – But Upside Potential & Safety are Poor

The VectorVest stock analysis tools tell you exactly what stocks to buy, when to buy them, and when to sell them. You never have to play the guessing game again or let emotions influence your decision-making. It’s all possible through the proprietary stock rating system used.

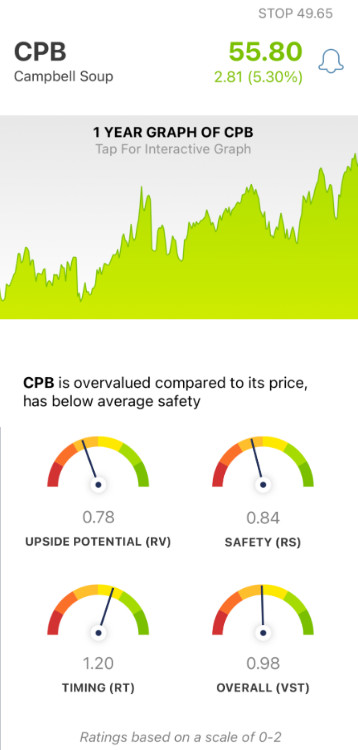

Instead of relying on countless technical indicators, you can just track three key ratings: relative value (RV), relative safety (RS), and relative timing (RT). These are easy to understand and gain insights from as they sit on a simple scale of 0.00-2.00. 1.00 is the average, and ratings over the average indicate overperformance. But the best part is that based on these three ratings, the system can actually provide you with a clear buy, sell, or hold recommendation. Here’s the current situation for CPB:

- Poor Upside Potential: The RV rating takes a look at a stock’s long-term price appreciation potential three years out. And right now, the RV rating of 0.78 is poor for CPB. Moreover, the stock is overvalued at its current price of $55.80 – the current value is just $31.91.

- Poor Safety: An indicator of risk, RS analyzes the financial consistency and predictability of a company, along with its debt-to-equity ratio and business longevity. Right now, CPB has a poor RS rating of 0.84.

- Good Timing: The one bright spot for CPB stock is the good RT rating of 1.20. This is calculated based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year to paint the full picture of a stock’s price trend.

All things considered, CPB stock has an overall VST rating of 0.98 which is just fair. So – what does that mean for you as an investor? Is it time to buy, or should you wait for the trend to strengthen just a bit more? Get a clear answer through our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for CPB, it is overvalued with poor upside potential and poor safety but has good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment