Shares of Sumo Logic (SUMO) are trading over 11% higher this morning after a positive 3rd quarter earnings report. The company outpaced the expectations from Wall Street analysts on both the top and bottom lines – but before you make your next move with this stock, we’ve identified 2 things you need to see. Before we unveil those, let’s unpack the earnings release.

Sumo Logic reported an increase in revenue of 27% over the 3rd quarter last year for a total of $79 million. Estimates were looking for $74.1 million. And that’s not the only beat that SUMO enjoyed last quarter. Wall Street analysts were expecting a non-GAAP loss of $0.15 per share – but results came in at just $0.04 per share. This was a dramatic improvement over last year’s loss of $0.12 per share.

Another positive KPI from the 3rd quarter was SUMO’s annual recurring revenue (ARR), which offers a look at subscription growth. The 22% increase resulted in subscription-based revenue for the quarter of $298.9 million.

CEO of Sumo Logic – Ramin Sayar – stated that all of this was the result of an increased focus on operating efficiency. The company will continue to put an emphasis on efficient growth as they move closer and closer to future cash flow break-even and eventually, profitability.

As we mentioned earlier, this report sent shares up almost 12% in Tuesday morning trading. But, it wasn’t just the 3rd quarter results that had investors excited about this stock – it’s the 4th quarter guidance.

Sumo Logic expects to beat analyst estimates again. In the final fiscal quarter, they’re looking to bring in revenue of $77.5 million (compared to consensus estimates of $75.4 million) and a 4th quarter loss of $0.09 per share (compared to consensus estimates of a 4th quarter loss of $0.17 per share).

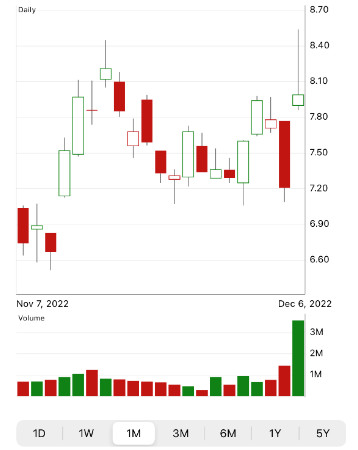

So – should you buy the stock now? The stock sits at an attractive price after dropping almost 40% in the last year and appears to be rising rapidly after today’s news. But, here are 2 things to take note of before making your decision…

Despite Good Timing, the Upside Potential & Safety is Poor for SUMO

The VectorVest stock forecasting software helps you simplify stock analysis through three easy-to-understand ratings: relative value (RV), relative safety (RS), and relative timing (RT). These sit on a scale of 0.00-2.00 – with 1.00 being the average. The higher the rating, the better. And based on these three ratings, VectorVest even provides a clear buy, sell, or hold recommendation. Here’s the current situation with SUMO:

- Poor Upside Potential: The RV rating takes a look at a stock’s long-term price appreciation potential over the next three years. Right now the RV rating is poor for SUMO at just 0.56. And, the stock is overvalued at its current price of $8.09 – with a current value of just $3.06.

- Poor Safety: Taking a look at the risk associated with SUMO, the RS rating of 0.69 is poor. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Good Timing: There is a positive price trend forming for SUMO – and the good RT rating of 1.16 reflects that. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

All this works out to an overall VST rating of 0.87 – which is fair. So – what should you do next? Should you buy SUMO or wait for further validation? Get a clear answer with a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SUMO, it is overvalued with poor upside potential and poor safety, but has good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment