Rackspace (RXT) sent out a press release over the weekend warning users of a security incident in the company’s hosted exchange environment. The news has created a frenzy and sent the stock down over 10% so far in Monday morning trading.

But, the potential breach at Rackspace isn’t the only reason investors may want to close out their positions. We’ve identified three red flags you need to see if you’re currently invested in RXT or considering buying in at a low point to get good value. More on that later – first, what is all the news about?

The issue began Friday, December 2. At first, the company claimed the issue was simply in regard to logins and connectivity. Since then, more details have come out as Rackspace was forced to acknowledge that the problem is actually a security incident.

But we still know very little about what’s going on – other than it could be catastrophic for companies affected by the security breach. What we do know for sure is that Rackspace themselves is in hot water – they themselves are calling this incident a significant failure.

Customers are not happy. Not only is the incident creating fear around sensitive data being leaked. But, we’re witnessing Rackspace drop the ball in real time as far as customer support is concerned. Users are reporting that they cannot get in touch with representatives via email, live chat, or even phone support.

The only information that we’ve gotten so far from Rackspace other than “there has been a security incident” is that users should migrate to Microsoft 365 in the meantime. Recognizing the damage they’ve caused, Rackspace is offering customers free Microsoft Exchange Plan 1 licenses.

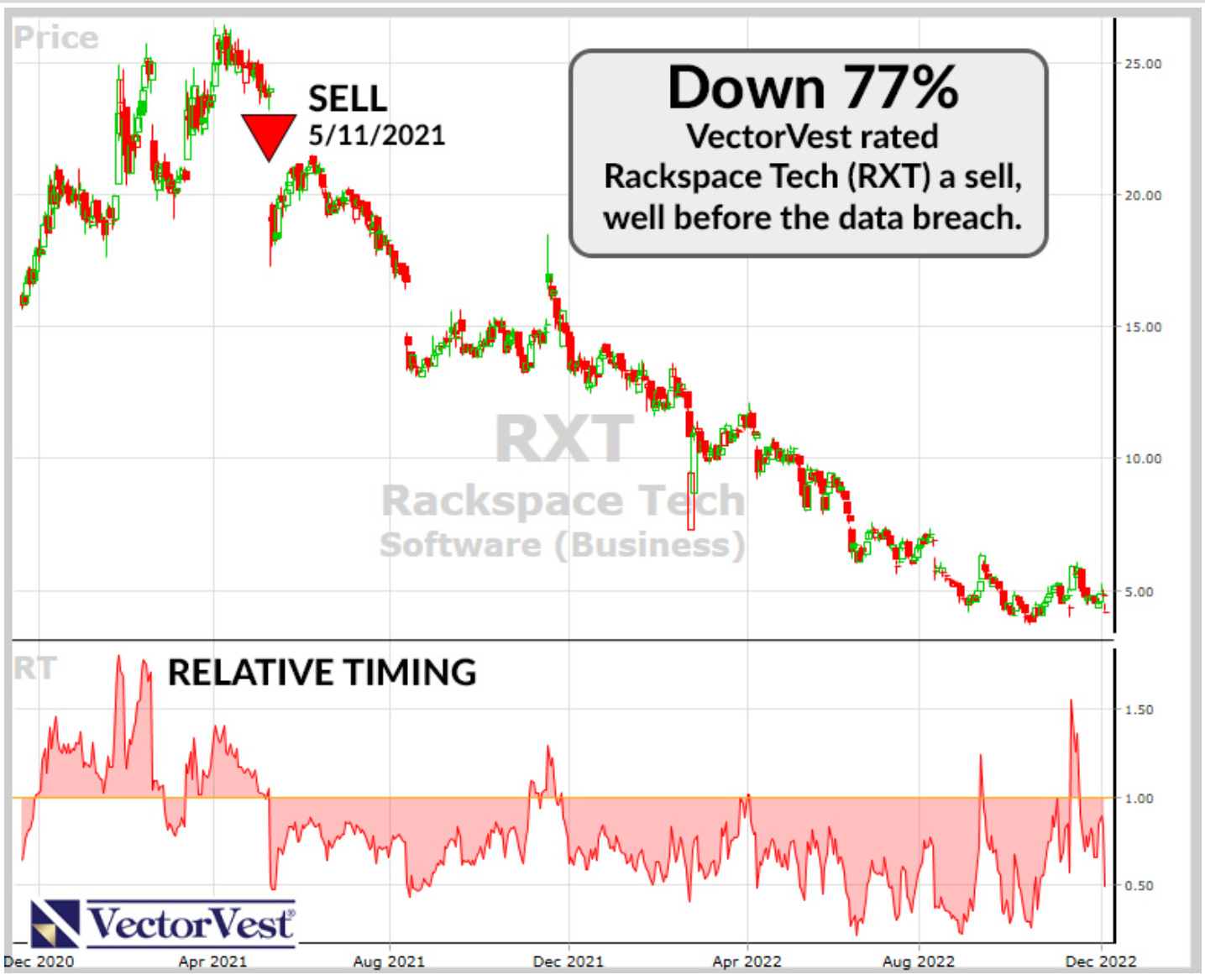

The extent of this incident still remains to be seen – who is affected? And what is the extent of the security incident? This is all happening in real-time. But if you’re currently invested in Rackspace, you cannot afford to wait for more details – you need answers now. And from a purely technical analysis perspective, we’ve identified three major red flags you need to be aware of through the VectorVest stock analyzing software.

Poor Upside Potential, Safety, and Timing for Rackspace Stock

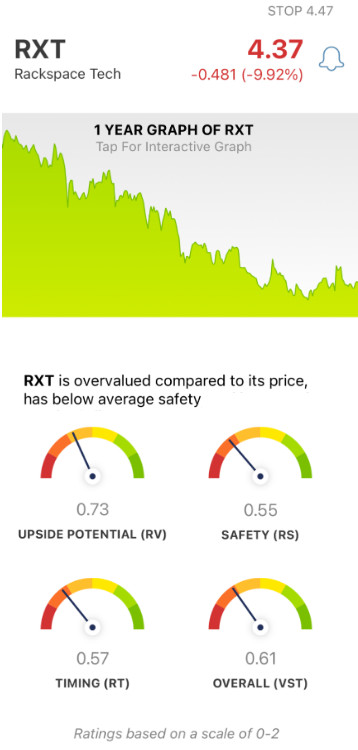

The VectorVest system transforms the way you approach stock analysis. Instead of relying on complex technical indicators, you’re given all the insights you need in just three easy-to-understand ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

These three ratings sit on a simple scale of 0.00-2.00, with 1.00 being the average. By picking stocks with above-average ratings, you increase your chances of winning more trades.

The best part, though, is that the system provides you with a clear buy, sell, or hold recommendation based on these three ratings. You can also be the first to know when conditions change and stocks move from “buy” to “sell”. No more guesswork or emotion clouding your judgment – just tried and true techniques that have outperformed the market for decades now! As for Rackspace, here’s the current situation:

- Poor Upside Potential: When taking a look at the long-term price appreciation potential for RXT, there isn’t much for investors to be hopeful about. VectorVest’s poor RV rating of 0.73 reflects that. Similarly, the stock is overvalued at the current price – with a current value of just $3.35/share.

- Poor Safety: The RS rating analyzes a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for RXT, the RS rating of 0.55 is poor.

- Poor Timing: As a result of the last few days, a negative price trend has taken hold of RXT stock – and the poor RT rating of 0.57 reflects that. This rating is based on the direction, dynamics, and magnitude of a stock’s price movement. It’s assessed day over day, week over week, quarter over quarter, and year over year.

All of these ratings contribute to an overall VST rating of just 0.61 – which is poor on a scale of 0.00-2.00. In the last year, the stock is down 77%. Does that mean it is finally time to sell? Get a clear answer to your next move through our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for RXT, it is overvalued with poor upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment