Scholastic Corporation (SCHL) reported Q2 earnings Thursday after the bell, sending shares lower in extended trading. They pick up where they left off Friday morning when the market opened, falling 12% so far.

This came after the company, which offers resources and tools for educators, families, and kids themselves, reported disappointing results for the second quarter of the year that fell short of analyst expectations.

Quarterly revenue of $562.60 million was a 4% decline year over year, and came in well below the analyst consensus of $625.22.

Meanwhile, profits improved slightly – operating income grew $1.2 million from the 2nd quarter of 2022. But, this marginal increase wasn’t enough. While the company’s quarterly earnings of $2.45 per share did represent a 16% improvement year over year, it was a disappointment compared to the $2.65 Wall Street was expecting.

Scholastic says the decline in revenue can be attributed to an increased focus on profitability. The company slashed spending on promotional efforts and cut unprofitable orders in Book Clubs.

Scholastic’s board also announced the approval of $66 million for its share buyback program.

But, the real takeaway from the earnings day for Scholastic was the downtrodden guidance for the remainder of the year. While the company initially forecasted adjusted EBITDA between $190 million and $200 million, the new range is $165 million and $175 million. Revenue was originally slated to grow 3-5% YoY, but now the goal is to simply come in level with no loss.

CEO and President Peter Warwick says that the company is happy with its performance in the 2nd quarter despite a complex environment in US Schools. That being said, investors are not – as the stock experienced a big sell-off with this news.

SCHL was rallying in the right direction leading into this news, up nearly 8% in the last month before falling off a cliff today. That being said, it’s not time to give up hope and sell shares – at least, according to the VectorVest stock forecasting software. We found 3 things you need to see.

Despite Poor Safety and Timing, SCHL Still Has Very Good Upside Potential

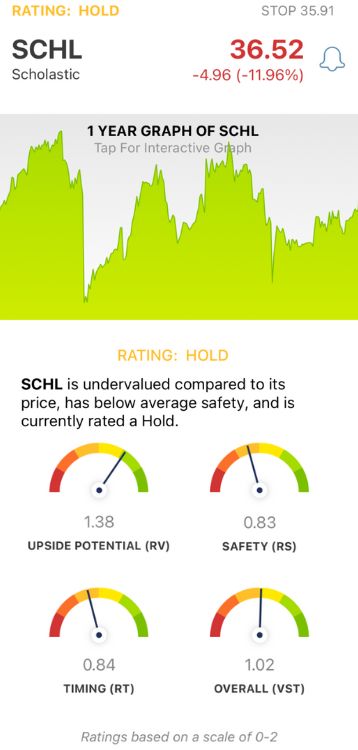

The VectorVest system is a proprietary stock rating system that saves you time and stress while empowering you to win more trades. You’re given clear, actionable insights in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. You’re even given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for SCHL, here’s what we’ve uncovered:

- Very Good Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. SCHL has a very good RV rating of 1.38. The stock is undervalued right now, with a current value of $53/share.

- Poor Safety: The RS rating is a risk indicator that’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. SCHL has a poor RS rating of 0.83 right now.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. After today’s performance, the stock has a poor RT rating of 0.84.

The overall VST rating of 1.02 is considered fair. As such, the VectorVest system rates SCHL a HOLD right now. We encourage you to learn more and stay up to date on this situation with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SCHL is down 12% Friday after reporting lackluster Q2 earnings alongside weak guidance for the remainder of the year. The stock has poor safety and timing, but its upside potential remains very good.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment