Shopify (SHOP) investors were delighted to witness a 27%+ jump in stock price this morning. But, those who have been invested in the company for a while are even more excited about the long-term outlook for the company, as the news that got us here today is that Shopify announced the sale of its logistics business.

This segment is something that the company invested heavily in during the pandemic, with hopes of competing with Amazon for seller logistics. But now, that portion of the business belongs to Flexport. In exchange, Shopify received a greater equity stake in the company of about 13%.

While this move represents a significant pivot for Shopify, it’s a decision that investors have been anxiously awaiting. The focus on logistics has bloated the company and taken away focus from the business’s primary needle movers. After this news, Shopify as a company got about 20% smaller – a good thing in the eyes of investors and analysts alike.

All of this came alongside Shopify’s first quarter earnings report, which entailed an increase in profits. The company reported a comprehensive income of $77 million compared to a loss of $1.5 billion this time last year. Revenue was up too, with a figure of $1.51 billion compared to $1.2 billion last year.

In closing out the earnings report, Chief Executive Tobias Lütke says that the road ahead involves a better balance of managers. This will lead to a more central focus on Shopify’s “main quest”, which involves offering merchants the best features available.

Now, whether you’re currently invested in SHOP or are considering adding the stock to your portfolio after this news, you’re going to want to see what we’ve uncovered through the VectorVest stock analysis software. There are 2 things, in particular, you’ll need to weigh before making your next move…

Very Poor Upside Potential vs Excellent Timing: Does One Outweigh the Other for SHOP?

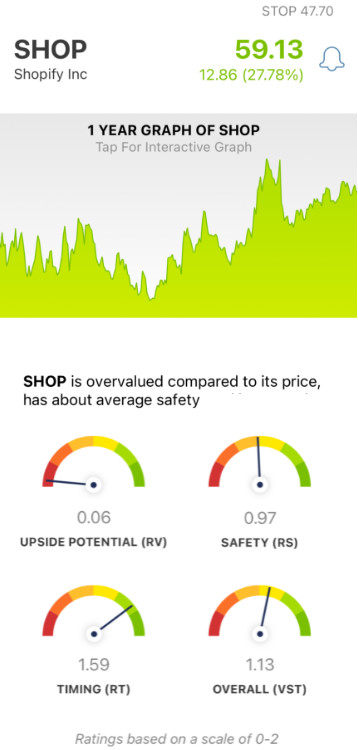

The VectorVest system simplifies your approach to stock analysis, giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, allowing for effortless interpretation. Just pick stocks with ratings appreciating above the average to win more trades!

Or, better yet, follow the clear buy, sell, or hold recommendation VectorVest issues based on these ratings - for any given stock, at any given time. As for SHOP, here’s what you need to know

- Very Poor Upside Potential: Despite the exciting shift within the company today, the stock itself still has very poor upside potential - with an RV rating of 0.06. This rating is derived from a comparison of the stock’s 3-year price projection to AAA corporate bond rates and risk. Furthermore, the stock is overvalued - its current value is just $5.60.

- Fair Safety: In terms of risk, SHOP is still a fairly safe stock - with an RS rating of 0.97. This is calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one thing SHOP has going for it right now is excellent timing pushing the stock’s price higher and higher today. The RT rating of 1.59 is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors.

The overall VST rating for SHOP is 1.13, which is good. So - does that mean excellent timing outweighs the very poor upside potential? Or, is it the other way around? Should you buy, sell, or hold this stock?

Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SHOP’s decision to offload the logistics business is a great long-term move - but right now, the upside potential is still very poor for this stock. Nevertheless, it has fair safety and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment