Target (TGT) reported fiscal third-quarter earnings before the bell this Wednesday morning, and the results sent shares into a frenzy. They’re up 17% so far this morning after the retailer beat the top and bottom line consensus.

For the past few quarters Target has faced a weakening environment as inflationary pressures have shoppers looking for deals and tightening their budgets. When individuals do splurge, it’s on experiences – not tangible items. But because many individuals still rely on Target for household essentials, they’ve managed to weather the storm.

Revenue of $25.4 billion narrowly outperformed the consensus on Wall Street of $25.24 billion. But, it was a step backward from last year when the company reported $26.52 billion.

Meanwhile, EPS of $2.10 beat out the consensus of $1.48 with ease. This was a big improvement year over year, and while Target certainly took measures to improve profitability this year, it’s more a testament to how bad profits were this time last year. The company was forced to clear out inventory at steep discounts in 2022.

This year, the team is practicing better inventory management to prevent a similar struggle going into the holiday season. The company has been focused on efficiency rather than boosting sales. But, Target executives say their attention will turn to promotion now as the peak shopping season looms large.

Looking ahead to the final quarter of the year Target is expecting to report another single-digit loss in sales growth, while earnings per share should fall within $1.90 to $2.60.

TGT has now climbed nearly 19% in the past week, recouping some of the damage this stock has faced over the past year. From issues with inventory to the disastrous backlash associated with the company’s LGBTQ+ line, the stock has been battered and bruised. It’s still trading 26% lower than it did this time last year.

But, there is light at the end of the tunnel. We’ve taken a look at TGT through the VectorVest stock analysis software and found 3 reasons it may be time to buy this stock…

TGT Has Fair Upside Potential and Safety With Excellent Timing

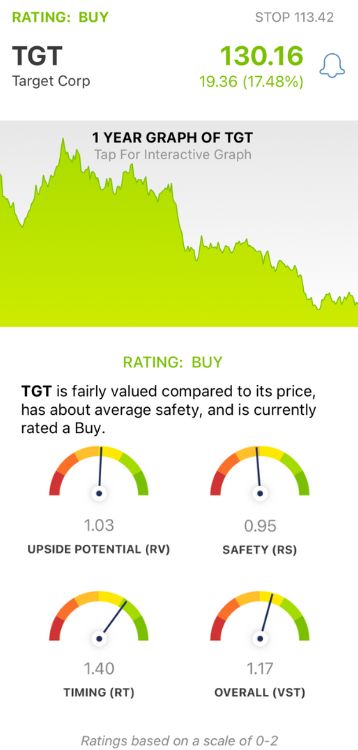

VectorVest uses a proprietary stock-rating system to simplify your trading strategy. It boils down all the insights you need to make calculated, emotionless decisions into 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even easier though, as VectorVest issues a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for TGT, here’s what you need to know:

- Fair Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (forecasted three years out) and AAA corporate bond rates & risk. This is a far better indicator than a simple comparison of price to value alone. TGT has a fair RV rating of 1.03, showing the stock is fairly valued at its current price.

- Fair Safety: The stock is also fairly safe with an RS rating of 0.95. This risk indicator is computed through a deep dive into the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other pertinent factors.

- Excellent Timing: As you can see by the stock’s performance in the past week, TGT has excellent timing, and the RT rating of 1.40 reflects that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.17 is good for TGT, and it’s enough to earn the stock a BUY recommendation in the VectorVest system.

Get a free stock analysis before making your next move to learn more about the current state of this stock, eliminating human error, guesswork, and emotion from your trading strategy once and for all!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. TGT gained 17% in Wednesday morning’s trading session after reporting third-quarter earnings that beat the consensus on the top and bottom lines. The stock has fair upside potential and safety with excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment