Early this morning Wingstop stock shares jumped over 20% and are counting, making them one of the market’s biggest movers.

This came as a result of an impressive Q3 earnings report alongside full-year earnings guidance. The company raised estimations after posting better-than-expected earnings in the third quarter – and investors have responded positively.

A huge reason for Wingstop’s excellent quarterly earnings report was a substantial decrease (43%) in the cost of bone-in wings. This contributed to a much more favorable margin and allowed the company to enjoy a 9.1% lower cost of sales from the previous year. This led to an improved profit margin of $13.4 million – up about $2.1 million from the previous year.

But lower costs weren’t the only reason the wing chain company overperformed. They also grew revenue at the top line, partially the result of eight new restaurants being opened in the NYC market. This helped the company push revenue up to $92.7 million compared to $65.8 million in the previous year. And, this exceeded analyst expectations by just under $3 million.

Along with a great third quarter, Wingstop has raised the full-year guidance – doubling down on the sentiment that they’ll finish the year strong. The new EPS estimate falls at $1.63/share compared to $1.61/share, while full-year selling, general, and administrative expenses have been cut by about $1.5-2 million.

As of 11:45 am EST this Wednesday, the WING share price has risen 20% and is up to $162. And this rally we’re seeing today is just a continuation of the trend we’ve witnessed over the past 3-month period. The stock has climbed 67% over the past 90 days, and it doesn’t appear it will slow down anytime soon.

So – is this your sign to get into WING stock? The VectorVest stock forecasting tools can provide you with a clear buy, sell, or hold recommendation for any given stock at any given time. Based on tried and true financial analysis, you don’t have to play the guessing game or let emotion influence your decision-making. There are really just two things you’ll need to weigh to determine if this is the right opportunity for you.

Does Poor Upside Potential Outweigh Excellent Timing or Vice Versa?

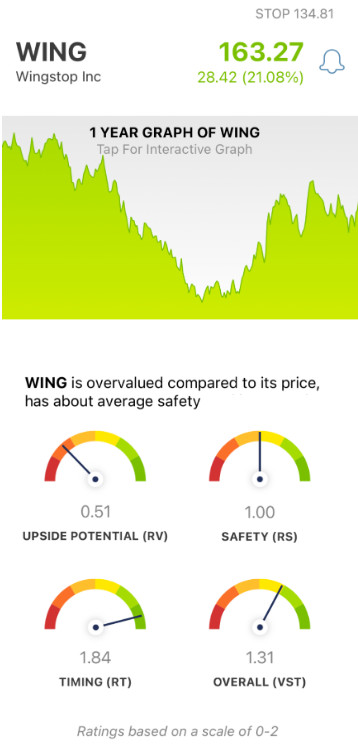

The VectorVest system simplifies trading by telling you everything you need to know about a stock in just three ratings: relative value (RV), relative safety (RS), and relative timing (RT). These are easy to interpret as they sit on a simple scale of 0.00-2.00 – with 1.00 being the average. Anything over the average indicates overperformance.

The best part is that based on these three ratings, the system can provide you with an overall rating for the stock and a clear buy, sell, or hold recommendation – allowing you to trade in confidence with minimal work. So, what’s the current situation with WING stock?

- Poor Upside Potential: Despite the dropping cost of bone-in wings and the revenue growth WING has shown in the past quarter, VectorVest calculates the current price of $163.42 to be overvalued – with a current value closer to $28.39. Moreover, the RV rating of 0.51 is poor – and indicates dismal long-term price appreciation potential.

- Fair Safety: The RS rating takes into account the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for WING, the RS rating of 1.00 is fair – right at the average.

- Excellent Timing: This is where things get interesting. There is an obvious positive price trend, and the VectorVest RT rating reflects that. This rating looks at the direction, dynamics, and magnitude of the stock’s price trend day over day, week over week, quarter over quarter, and year over year. As for WING, the RT rating of 1.84 is excellent.

All this considered, the overall VST rating for WING is 1.30 – which is very good on a scale of 0.00-2.00. But does this necessarily mean you should buy the stock – does the excellent timing outweigh poor upside potential, or is it the other way around? To get a clear recommendation on your next move with WING, get a free stock analysis – VectorVest will tell you exactly what to do.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for WING, it is overvalued with poor upside potential, has fair safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment